Company attributes drop in sales to July flooding of plant in Orleans, Vermont, and a slowdown in business

DANBURY, Conn. — Ethan Allen Interiors reported a 23.6% drop in consolidated net sales and a 43.5% drop in adjusted net income for its first fiscal quarter ended Sept. 30.

The company reported net sales of $163.9 million during the period, compared to $214.5 million during the same quarter in 2022. Its adjusted net income totaled $16.1 million, or 63 cents per share, compared to net income of $28.4 million, or $1.11 per share, for the same period last year.

The company said net sales were impacted by major flooding at its plant in Orleans, Vermont, in July combined with strong prior-year results that were due to the delivery of pandemic-related written-order backlog.

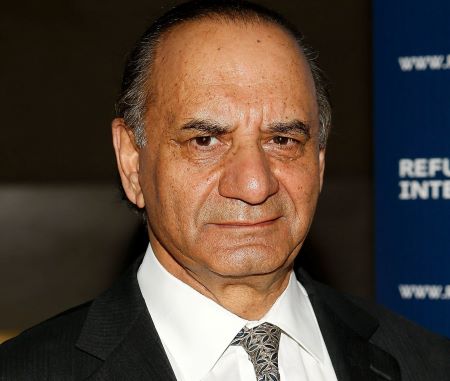

Company Chairman, President and CEO Farooq Kathwari noted that the flooding alone negatively impacted sales by $15 million and that its wood manufacturing operations sustained damage that resulted in a pre-tax charge of $2.1 million, which is net of insurance and grant proceeds. He added that the company resumed limited operations during the second half of the quarter and that most of its associates are back to work.

“Although we continue to work through the cleanup and repair, as our work is ongoing, we are pleased to say we remain open for business in Vermont and are actively working on the production of our custom orders,” he said.

Kathwari added that despite the challenges — including a slow economy — the company maintained a gross margin of 61.1% and an adjusted operating margin of 12.1%. He added that the company also generated positive operating cash flow with total cash and investments of $163.2 million and no debt.

Other highlights of the report are as follows:

+ Retail net sales totaled $133.6 million, down 27.3% from last year, while wholesale net sales of $99.4 million were down 13.3%.

+ Written orders in the retail segment decreased 13.2% during the quarter, while written orders in the wholesale segment decreased 15.6%.

+ Customer deposits from written orders totaled $77.9 million as of Sept. 30, compared with $77.8 million as of June 30. The wholesale order backlog was $75.4 million as of Sept. 30, down 28.6% from last year, but up from $74 million as of June 30, which the company said was due to the timing of incoming contract orders.

+ Consolidated gross margin was 61.1% compared to 60.4% last year. The company attributed this to a favorable product mix and lower input costs including reduced inbound freight and raw materials costs, which was partly offset by lower delivered unit volume and a change in the sales mix.

+ The company’s adjusted operating margin was 12.1% compared with 17.6% last year, which the company said was due to fixed costs deleveraging from lower consolidated net sales and expenses incurred with the launch of its Interior Design Destination initiative, including projection, new product display, merchandising and sample costs. This was partly offset by gross margin expansion, lower headcount and various costs savings and expense controls.

+ Its advertising expenses were 2% of net sales compared to 2.5% in the prior-year first quarter. “Promotional activity remained disciplined and was comparable to the prior year.”

+ The company generated $16.7 million in cash from operating activities compared with $38.4 million last year and ended the quarter with $163.2 million in cash and investments compared to $172.7 million as of June 30, 2023. The company said this was primarily due to the payment of $21.9 million in cash dividends during the quarter and capital expenditures of $3.7 million “as the company continues to return capital to shareholders and reinvest back into the business.”

+ The company also reduced inventory levels to $149.6 million by Sept. 30, compared to $167.6 million last year, a 10.8% decrease. The company said this has occurred as it “aligns its inventory with incoming order trends while also ensuring the appropriate levels are maintained to service customers.”

+ Ethan Allen also held several design center grand openings during the quarter as part of its Interior Design Destination initiative. More are planned in the coming months.

+ New state-of-the-art design centers were opened in The Villages, Florida; Avon, Ohio; and New York City.