How furniture today is like a pair of Air Jordans, and not in a good way

Thomasville upholstery on sale at Costco? Broyhill available exclusively at Big Lots? Drexel in boxes at Sam’s Club? Has the furniture world gone crazy? For the proverbial Rip van Winkle, waking up to this roster of distribution for an erstwhile league of premium brands would be startling, horrifying, mystifying.

“Hey, Rip! Strap on your Fitbit, buddy! It’s time to get your steps in! Let’s shake out the cobwebs and go for a walk.”

In the ironic doublespeak of corporate America, it’s an entity called “Authentic Brands Group” that owns these once-authentic brands. ABG is super quick to point out, “We don’t manufacture anything!” In positioning for an IPO, this is actually a boast. “Invest in us! We don’t get our hands dirty making anything!”

Of course, Thomasville, Henredon, Drexel Heritage and Broyhill once and for a very long time proudly manufactured furniture, and all four of them in the state of North Carolina. Two of those names are borrowed from the towns in which they were born – Thomasville and Drexel. Their plight was and remains the U.S. furniture industry in microcosm: Cheap imports, commodity pricing at retail, and legacy brands with diminishing value in a confused marketplace that has been over-taken by outsourcing, private labels and third parties. It wasn’t all that long ago that Vaughan-Bassett’s “Made in America” claim, trumpeted during the mass migration of manufacturing to China, was the “authentic” boast.

Curb fruit

ABG snapped up these once-hallowed names in an asset sale three years ago. That’s right, Henredon had been reduced to curb fruit. And many of us thought Masco was the faceless face of the corporate shill. After all, Masco sold out Henredon, Drexel Heritage, Lexington, Universal, Berkline, Bench Craft, Maitland-Smith and Robert Allen Fabrics in 1995 to Morgan Stanley for about a billion bucks. The benefit, other than the billion? A $600 million write-off. That’s right, these once-lustrous brands were dumped off at Goodwill for a receipt to attach to next year’s tax filing. And on news of the divestiture, Masco’s stock price went up.

“But, hey, Rip, get real. What do you think China and Vietnam are for? No one actually makes their own products anymore.”

It’s mostly true. A horrific garment factory collapse in Dhaka, Bangladesh several years ago, a disaster that injured more than 2,500 people, revealed that “brand name” goods for Gucci, Versace, Benetton and Walmart were manufactured in the same building, just on different floors. What’s the difference between a pair of khaki pants made on, say, the third floor as compared to a pair coming off the fourth? About $150?

In a letter from CEO Jamie Salter as part of ABG’s IPO prospectus, he boasts that “ABG deconstructs and reconstructs the traditional model, owning only the brands, creating a decentralized network of best-in-class partners to execute the rest of the value chain.”

Whaa?

First of all, you can’t deconstruct a traditional model, reconstruct it and continue to call it “the traditional model,” unless of course you rebuilt exactly the same model, which wouldn’t be a selling point at all. This inane statement is the functional equivalent of claiming to have “revolutionized” an industry, as countless companies have done over the years, because to complete a revolution is to return to exactly the same spot from which you began.

Why would anyone reconstruct a “traditional” model of anything? This empty claim is likely meant to reassure the marketplace by simply using the words “traditional model” in a sentence, because there’s nothing traditional at all except for the brand cache on loan from the past.

“Well, it’s basically a Rolex. I mean, it says, ‘Rolex’ right there on the watch.”

Second, if your network is decentralized, what does that network need you for? Aren’t the brands the “center” of this galaxy of mostly empty space? Isn’t someone at the wheel? “First-in-class?” By what metric, exactly? If you know which “partners” are first, presumably you know also which factories are second-in-class. No, “first-in-class” is another empty, unverified and, therefore, hollow description meant to reassure the otherwise ignorant marketplace.

Just don’t do it

Of course, one of the most prominent examples of “not manufacturing anything” is Nike. The only thing this “authentic” brand produces is image; the Big Swoosh is, in fact, an advertising and marketing company. Clearly the model works, because the percent of shoes sold in the United States made in country now is less than 1%, and this lost industry is largely the result of Nike and its “decentralized network of best-in-class partners.”

Air Jordans, for example, are, truth be told, pretty crap shoes from a manufacturing perspective. Just ask Zion Williamson about his big blowout during his final game against UNC. Or ask me: I had a sole come completely off my original grape Jordan Vs walking down Beale Street in Memphis several years back. And yet, Jordans sell (and then re-sell) for hundreds, even thousands on eBay, even used, because the marketing is so good. Nike sells emotion, dreams, and being like Mike. Heck, Zion even signed with Jordan Brand upon entering the NBA post-blowout, “citing his admiration for Michael Jordan,” according to one news report.

Of course, when an entire industry moves production offshore, the domestic support and supply network also dries up. There’s no going back, in other words. And all those skilled furniture makers in western North Carolina? Some of them likely turned to re-selling Air Jordans to make a buck.

“We are brand owners, curators and guardians,” Salter also wrote, if any “authentic” writing he actually did. Don’t CEOs have people for that? “We don’t manage stores, inventory, or supply chains.”

Guardians? Really? Just who is it that’s storming the ramparts of Henredon or Drexel?

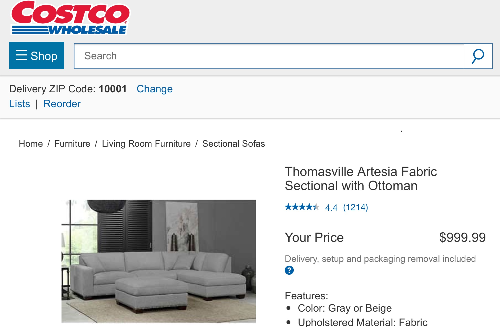

“Curators?” Seriously? Costco and Wayfair? If that’s “curating” the Thomasville brand, please, whatever you do, ABG, don’t go into the museum business. We don’t want Picasso or Pissarro ending up in the Icelandic Phallological Museum (https://phallus.is/en/). (No disrespect to either Costco or Wayfair intended. I swear by Costco’s olive oil and rotisserie chicken.)

Now, while it might work on Wall Street to proudly assert, “We don’t manufacture or manage anything,” connoting as it does risk avoidance by leaving the logistics, supply chain convulsions, emissions standards, child labor laws and even rent to others, to the Rip van Winkle from an era in which things like infrastructure, jobs, product integrity, and, you know, authentic authenticity actually mattered, such “boasts” are troubling at best. They are even disturbing as language, as semantics, in hollowing out as they do the very meaning of words.

But, as for Nike, this business model based on and unabashedly proud of not manufacturing or managing anything does seem to work. According to its IPO filing this month, ABG doubled its net income in 2020, a year of pandemic, to $225.3 million. For the first quarter of this year, net income nearly quadrupled to approximately $295 million. ABG clearly is making bank by “not making anything.” Hey, it’s the American way. Let’s make Thomasville great again . . . at Costco. Well, let’s at least slap the Thomasville name on some youth furniture.

“Hey, Rip! Give back the Fitbit. Forget the walk in the park, bud. Maybe it’s better you just went back to sleep. The ‘modern’ world might not be for you.”

Got a topic you want Brian Carroll to address? Let him know at tarheelblue@gmail.com.