City Furniture, Living Spaces find a happy medium between offering costly no-interest financing and arguably offering a better deal for all parties

For years now, a holiday weekend hasn’t gone by without many major furniture retailers enticing consumers in with a big five-year, no-interest financing promotion. It has gone hand-in-hand with 20% to 70% discounts. Sure, in this era of pandemic-fueled supply disruption and inflation, more retailers have pitched “in-stock” just as heavily and maybe even pulled back slightly on deep discounts, but through it all, five-year, zero-interest has remained the go-to offer.

The reason why we usually only see this only around a holiday or other important extended weekend events is because it can get pretty darned expensive. Sources tell me that retailers often pay finance companies upwards of 12% to 15% for the privilege of the offer. In other words, when the retailer sells $1,000 worth of furniture to a customer financing under the no-interest program, the store actually only gets $850 to $880 of that ticket from the credit card company. Consider the rest the lender’s cut for taking on the long-term risk.

So I was interested to learn two of the industry’s largest retail players — City Furniture of Tamarac, Fla., and Living Spaces of La Mirada, Calif., — recently introduced a new twist on the five-year plan. Instead of five years interest-free, customers get five years at roughly a 10% interest rate (9.99% to be exact). When I first heard about this, it didn’t sound like such a great deal to me. And, in one sense, it isn’t for the customer, who has grown accustomed to financing something for five years without any interest charge at all.

But in another sense, it might be exactly what this industry and consumers need right about now, and here’s why:

First, the offer doesn’t appear timed to a holiday or other event. Consumers can take all the time they need to make this highly considered purchase, and the retailer gets a more consistent flow of business. Ultimately, this could smooth those hard-to-forecast big spikes in sales around the holidays. A steadier sales flow means stores are easier to staff (think labor shortage), and it’s easier to take care of customers.

Second, since the finance company isn’t taking on as much risk, the retailer doesn’t have to pay as much to that credit card company. I’m told that the 12% to 15% discount likely drops to somewhere in the neighborhood of 2%, and the dollars flowing to the retailer from a $1,000 sale climb to about $980 from the previous $850 to $880 range. (These are educated estimates; City Furniture declined an interview for this story, and Living Spaces didn’t respond to requests for information. Both use Synchrony Bank for the program).

And in addition to taking on less risk, the finance company also stands to gain more money, too. Under the usual five-year, no interest deal, the lender collects about $150 from the retailer up front on that $1,000 purchase. Under a five-year, 10% plan, that same lender would collect nearly $275 from the consumer plus, say, 2% of the ticket, or another $20, from the retailer. That’s just about double the money.

So what does the customer get out of all this other than a 10% interest rate and some more time to consider that living room group? My best guess is they’re getting a closer-to-honest price from the retailer when they walk in the store or shop online. If the retailer doesn’t have to pay through the nose for a 0% offer, it doesn’t have to jack up its prices to cover the cost, either. That item that should sell for $800 actually retails for $800, not $1,000, because the retailer is able to keep more of the ticket.

At a time when consumers are experiencing inflation at every turn, you can see why this might make sense for both consumers and retailers and why we may see more stores adopt it soon. That 9.99% rate consumers pay, by the way, is still a pretty good deal, at least when compared to a more typical credit card rate of, say, 29.9% (which is what they could end up paying if they don’t pay off the balance in time). At 29.9%, a consumer would pay about $940 in interest over five years (if they took the full term to pay) or almost as much as the original purchase price. And the monthly payments would be greater, too.

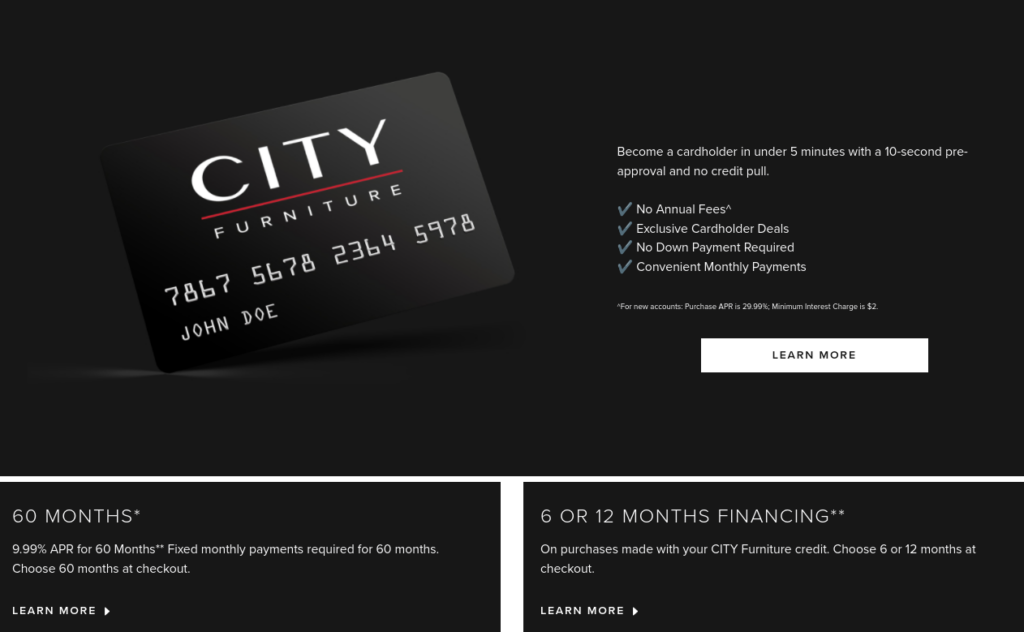

Both City and Living Spaces are currently offering a version of no-interest financing, too, but for shorter than five-year terms. Living Spaces’ shorter offers currently are tied to a promotional period ending Feb. 27 and include three-years, no-interest on purchases of $3,000 or more all the way down to six-months no-interest on purchases of $150 or more. City’s website currently shows six- to 12-months no interest in addition to the five-year. 9.99% plan as well as other cascading finance options.

Another advantage of this switch up: I’m told that approvals rates are better for the five-year, 10% plan vs. the no-interest offer. And remember, for the majority of customers paying with cash or with their own credit card — they’re likely going to see lower prices across the board. The retailer no longer has to load retail prices to satisfy that smaller segment taking advantage of the no-interest deal.

Of course, you’re not likely to find many consumers willing to say, “Yes, I’ll take 10% interest over 0% interest any day,” so retailers offering the new twist need to fully explain or even prove how their prices are better than the competition because they’re turning over less money to the banks.

While most consumers still don’t know what a sofa is supposed to cost, their demand for home goods has never been greater, so they may have a better understanding of price ranges and price points than we think.

And that’s something worth thinking about as we continue to balance consumer demand and expectations with the added pressures of price increases, backorders and labor issues. Interest rates are going up. Prices are going up. Long-term interest-free financing doesn’t seem to make good business sense anymore. (Did it ever?)

If five-year, no-interest financing is an expensive drug that, nevertheless, creates business and encourages bigger tickets, maybe five years, some interest is the precision tool that gives all parties involved a fair deal, while keeping inflation under control and the customer coming back for the next big purchase.