Survey reflects concerns about inflation and current political situation

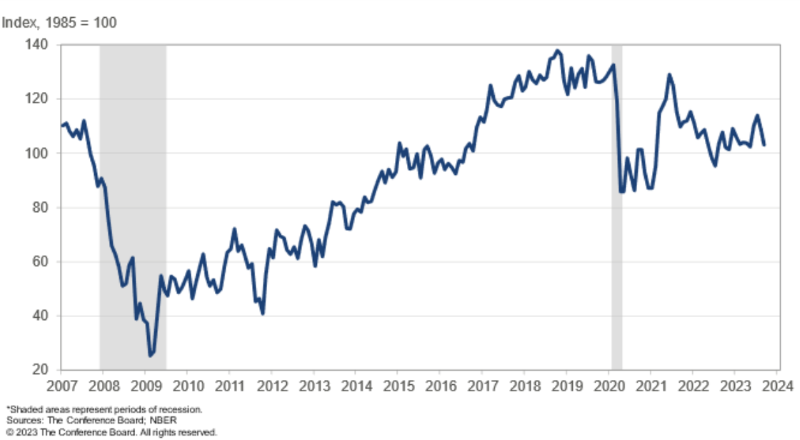

WASHINGTON — Consumer confidence fell again in September, the second month of consecutive declines, which the Conference Board said was partly due to ongoing consumer concerns about current interest rates and the current political environment.

The board reported that the Consumer Confidence Index declined to 103 from a revised 108.7 in August. Meanwhile, the Present Situation Index, which is based on consumers’ assessment of current business and labor market conditions, rose to 147.1 from 146.7, a slight gain.

The Expectations Index, which is based on consumers’ short-term outlook for income, business and labor market conditions, dropped to 73.7, down from 83.3 in August. A score below 80 signals a recession within the next year, as “Consumer fears of an impending recession also ticked back up, consistent with the short and shallow economic contraction we anticipate for the first half of 2024,” the Conference Board noted.

“Consumer confidence fell again in September 2023, marking two consecutive months of decline,” said Dana Peterson, chief economist at The Conference Board. “September’s disappointing headline number reflected another decline in the Expectations Index, as the Present Situation Index was little changed. Write-in responses showed that consumers continued to be preoccupied with rising prices in general, and for groceries and gasoline in particular.”

Peterson also noted that the decline in consumer confidence was seen across all age groups, and particularly among consumers with household incomes of $50,000 or more.

While the board noted that little had changed with the Present Situation Index, fewer consumers described business conditions as good, while fewer still said they were bad. For example, 20.9% of consumers said that business conditions were good, compared to 21.5% in August. Some 16.4% of consumers said business conditions were bad, down from 17.3% in August.

Of employment, slightly more consumers said that jobs were plentiful while some said jobs were hard to get. For example, 40.9% of consumers said jobs were plentiful, up from 39.9% in August, and 13.6% said jobs were hard to get, compared to 13.2% in August.

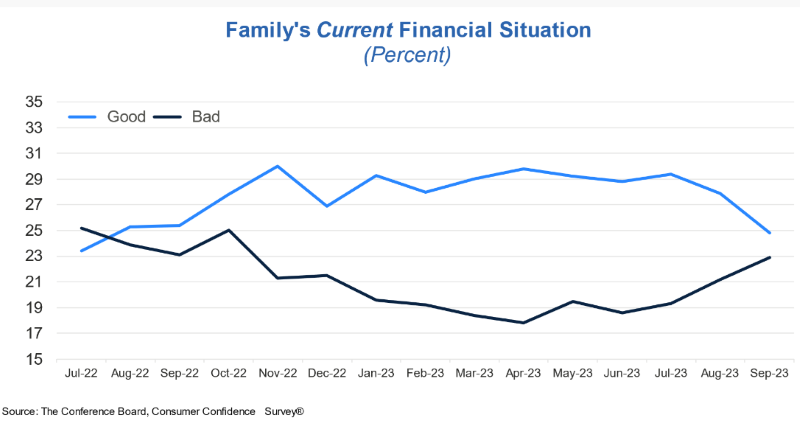

Of current family situations, the number of respondents citing a good situation fell, while those citing bad conditions rose, which indicates concerns about their current finances.

Expectations also faltered, with consumers less optimistic about the short-term business outlook over the next six months, the Conference Board said. In September, 14.1% of consumers said they expect business conditions to improve, down from 17.5% in August, while 18.4% expect business conditions to worsen, up from 17.3% in August.

Meanwhile the short-term labor market outlook was lower in September, with 15.5% of consumers expecting more jobs to be available in six months, down from 17.5% in August, and 18.9% anticipating fewer jobs, up from 18%. Negative views about short-term prospects also rose, with 16.3% of consumers expecting their incomes to increase, down from 18.7% in August. Some 14.4% expect their incomes to decrease, up from 11.9% in August.

“Expectations for the next six months tumbled back below the recession threshold of 80, reflecting less confidence about future business conditions, job availability and incomes,” Peterson said. “Consumers may be hearing more bad news about corporate earnings, while job openings are narrowing, and interest rates continue to rise — making big-ticket items more expensive. Expectations for interest rates declined in September after surging in the prior month, but the outlook for stock prices continued to fall.”

Peterson added that average 12-month inflation expectations have held steady the past three months despite ongoing complaints about higher prices.