HIGH POINT — With our Consumer Insights Now research, we have seen some common themes emerge in terms of what people are looking to buy in the second half of this year.

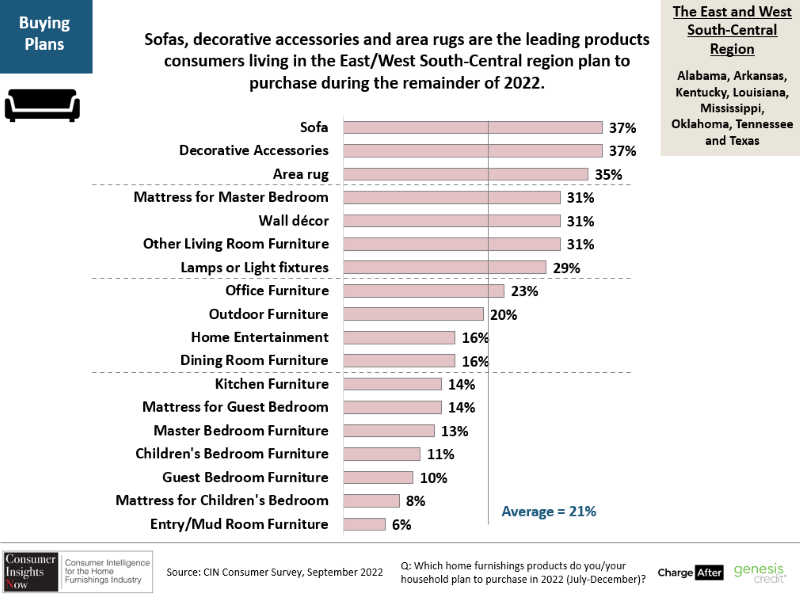

The living room remains a core area of interest in the home, with sofas, decorative accessories and area rugs being among the most popular items, followed by bedding, wall décor and other living room furniture, including accents and occasional pieces.

These themes also emerge in our latest regional report which surveyed some 350 respondents in the East and West South-Central part of the country, which includes states in the deep South including Alabama, Arkansas, Kentucky, Louisiana, Mississippi, Oklahoma, Tennessee and Texas.

Not surprisingly, given the climate in this region, outdoor remains an area of major interest, with 20% of those surveyed planning to purchase outdoor furniture in the second half. Home office and home entertainment furniture also remain important, with 23% and 16%of those surveyed planning to buy items in these categories. Dining was another area of interest to some 16% of the respondents.

These categories were popular during the pandemic and continue to be so, as working and entertaining at home became habits as did preparing meals and dining at home.

Falling further down the list in area of importance? A mattress for a second or guest bedroom (14%), master bedroom furniture (13%), children’s bedroom furniture (11%), guest bedroom furniture (11%), a mattress for a children’s bedroom (8%) and entry way or mudroom furniture (6%).

Rooms that consumers have a high priority to redecorate include living room and outdoor entertaining areas — both in the top five areas of the home. These were in addition to the family room and den and master bedroom, although the master bedroom ranking at number two on the list could be due to consumers’ interest in buying a mattress for the master bedroom versus an entire bedroom suite.

Equally of interest were some of the consumer comments about how the furniture buying experience can be improved.

Here are some notable comments from real consumers about what they want:

+ “More affordable, decent furniture for those of us who are not millionaires. The 99% deserve decent furniture that doesn’t fall apart, too.”

+ “An easy way to virtually see what the furniture would look like in my home.”

+ “In stock furniture, lower prices and not charge so much for delivery.”

+ “Clearer descriptions online and the ability to see how it would look in my space.”

+ “Start making more solid wood furniture. Not this fake crap you see everywhere now.”

The same survey notes that for many of these consumers, brick and mortar remains high on their list of places to shop. Nearly 70% said they plan to shop local furniture stores and 50% of those surveyed said national furniture chains, which was tied with online retailers and e-commerce platforms.

Also notable was that many consumers research manufacturers themselves. Some 66% said they sometimes do so before making a purchase while 20% said they always do. This included a significant number of younger millennials ages 26-33 and GenX consumers ages 42-56.

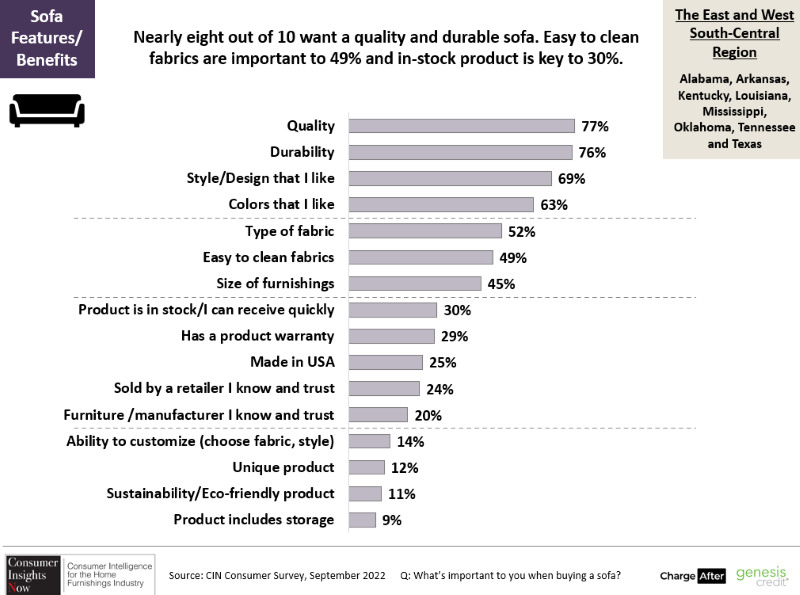

And what are some of the qualities they are seeking as they do research? In upholstery, top key features and benefits include quality (77%); durability (76%); style and design (69%) colors (63%); type of fabric (52%) easy to clean fabrics (49%) and size (45%). Other key areas of interest include quick delivery, warranties, made in USA and sold by a retailer and then manufacturer I know and trust.

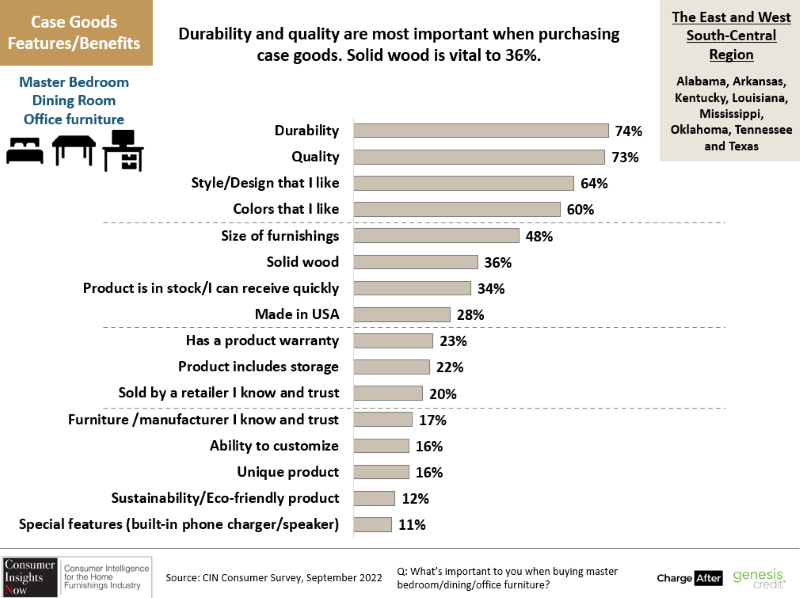

On the wood side for categories including bedroom, dining room and home office, durability and quality also ranked highest at (74% and 73% respectively); style and design and colors I like (64% and 60%); followed by the size of the furniture (48%) and solid wood (36%); product I can receive quickly (34%) and made in USA (28%). Other key considerations in order were whether the product has a warranty, product with ample storage, whether it was sold by a retailer and manufacturer I know and trust and the ability to customize.

Lower on the list for both upholstery and wood product were sustainability and special features such as built-in phone chargers or speakers.

We hope these and other aspects of this regional report provide a window into what today’s consumer wants. Our goal, as always, is to provide relevant and timely information that helps you run your business now and in the future.

The Consumer Insights Now Survey was among 1,993 U.S. consumers in total, with 346 respondents live in the East and West South-Central region of the U.S. All respondents plan to purchase one or more home furnishings products between July and December 2022. All respondents are either the primary or joint purchase decision maker. The sample includes a mix of females and males, ages 18 to 74 and includes a representative mix of ages, ethnicities, household incomes and homeowners/renters. The survey was fielded July 11 – 13, 2022 and is sponsored by Charge After and Genesis Credit.

Kudos are to be extended to HNN and their CIN analytical team. HNNs collected regional consumer-based information is most appreciated by this writer, and assuredly, many dealers all-across the country as well. Lots of comprehensive tangible and fresh prospect-stuff … normally not sorted in this particular format. Priceless! Looking forward to your next report.

Thanks,

Dan

Thanks very much for the kind words, Dan – we are glad you liked our research and look forward to providing more of this type of information in the future!

Tom Russell