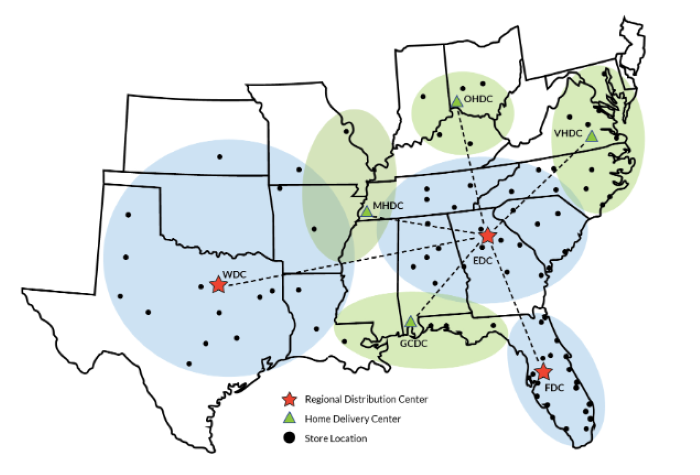

Company’s growing retail network is supported by regional distribution and home delivery centers

ATLANTA — Despite a slowdown in consumer spending on home furnishings, Havertys is playing the long game by focusing on opportunities to grow its business in the months and years ahead.

During its latest conference call addressing its first quarter ended March 31, it highlighted plans for new stores that will expand its reach into new markets where new and existing consumers familiar with the brand will have a chance to shop closer to where they live.

With a total of 124 locations in 86 cities and 16 states as of Dec. 31, 2023, the company said it has several new stores on tap this calendar year including one that opened in Durham, North Carolina, in February, one that opened in Southaven, Mississippi, in March and three more set to open in Florida, during the second and third quarters.

Later this year during its fourth quarter, it plans to open another several stores including one in Houston, one in Concord, North Carolina, one in Dayton, Ohio, and a location just south of Richmond, Virginia.

Driving this development is what Chairman and CEO Clarence Smith described as “a long 138-year history of gaining market share during difficult times, and we believe that we’re in an exceptionally strong position with our solid balance sheet to grow our store count in our regions.”

Also supporting this growth initiative is a logistics network that includes three large regional distribution centers in northeast Texas, in the Tampa area of western Florida and the Atlanta area of northeastern Georgia.

It also has four home delivery centers in western Tennessee, southwestern Ohio, the western Florida/southwest Alabama panhandle and just west of Tidewater Virginia. With this network in place, the company said in its annual report that the average delivery times for in-stock items is three to five days and five to seven weeks for special-order items.

“Our development and real estate teams are actively evaluating and reviewing the number of store opportunities that we’re seeing in our delivery footprint,” Smith said during the call. “We’ve invested, upgraded and repositioned our stores in our 16-state footprint over the past several years, which sets us up to be able to add to our store fleet.”

He added that the distribution network also is positioned to serve several more states beyond its current footprint.

“We think there will be a number of retail locations that will be available in the coming months that would help us reach new markets and expand our presence in existing markets,” he noted.

The growth plans are being supported with an aggressive $53.2 million capital spending plan for the year, including:

+ The $28.2 million purchase of its Florida distribution center which is expected to close during the second quarter.

+ $16.7 million being invested in new and replacement stores.

+ $5.8 million further investments and upgrades to its distribution network.

+ $2.5 million of spending in its information technology network.

Will business in the near future support these initiatives and growth plans?

Obviously much will depend on the housing market, along with the continued success of various segments of its business. The company has already some of these success stories, including the company’s design services. For example, during the conference call, President Steve Burdette said this segment represents 26% of its business overall, with the average ticket for that business rising by about 11% during the quarter.

“We expect our design business to continue to grow as we create more awareness and focus on each customer’s experience,” Burdette said.

But that also leaves room for additional growth, particularly in the core, non-special-order case goods and upholstery categories driving the balance of its sales. As with most retailers around the country, we expect that competitive pricing in these segments will remain an important factor in Havertys’ long-term success in both imports and domestic goods.

Even in a strong housing market, consumers will continue to seek out the best values they can find, particularly in highly competitive markets where Havertys continues to grow its business.