DALLAS – Corsicana said it expects to continue its ongoing operations thanks to the availability of $58 million in debtor-in-possession financing facilities approved as part of first-day motions granted in its Chapter 11 bankruptcy case.

The $58 million in DIP financing provides the company with up to $18 million in term loans from Blue Torch Finance LLC, the stalking-horse bidder that is looking to acquire the company, and up to $40 million in revolving loans from Wingspire Capital LLC.

The U.S. Bankruptcy Court for the Northern District of Texas granted all the first-day motions filed by the company and various affiliates.

The court’s approval allows the company to meet payroll, benefits and other expenses for its full and part-time employees. It also grants it the authority to use existing bank accounts, maintain its insurance programs; pay outstanding taxes; ensure no disruption from utility providers and continue customer programs.

In addition to servicing customers and paying employees, the company said the motions also will allow it to pay vendors and suppliers for services provided and goods received during the bankruptcy process.

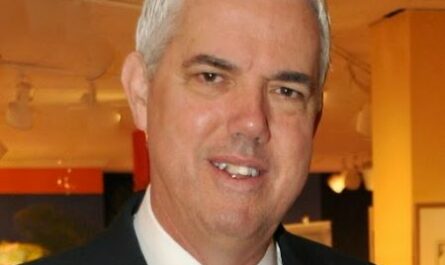

“We are obviously pleased the court saw fit to grant all our first-day motions to allow us to continue to service our customers and care for our dedicated employees as we go through the Chapter 11 process,” said CEO Eric Rhea. “The Chapter 11 process will enable Corsicana to emerge as a company re-focused on its core customers, who we will service with greater effectiveness and efficiency in all aspects of our operations.”