However, nearly 40% anticipate spending on home furnishings to increase in the 2nd half

HIGH POINT — A survey by TD Bank at the recently concluded High Point Market shows that nearly half of respondents said that economic uncertainty is their biggest concern that could impact their businesses within the next six months.

Some 49% of those surveyed during the April 13-17 event identified this as their biggest concern, followed by price increases from suppliers, 13%, and price increases from inflation, 11%.

Just over 8% respectively said that they were concerned about continuing supply chain disruptions along with reaching new customers and clients in order to grow their businesses. Six percent said that maintaining customer loyalty was key to their business in the coming months and beyond.

TD Bank fielded the survey during the market and the sample size included 135 respondents.

Other highlights from the survey were as follows:

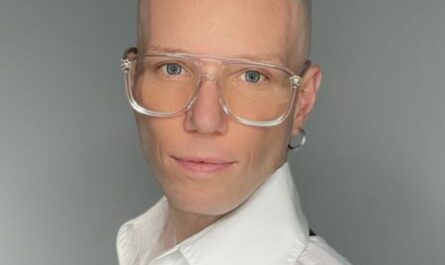

+ Some 39% of respondents said they expect the purchase of home furnishings to increase in the second half, while 36% expect it to remain steady.

+ Another 10% said they expect consumer purchases of home furnishings to decrease.

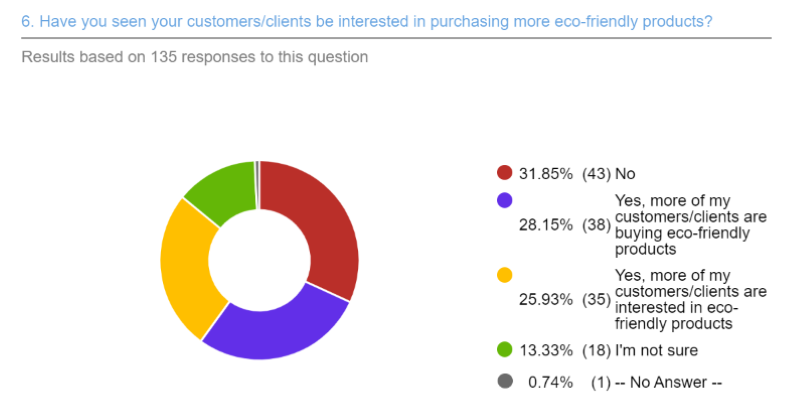

+ In addition, 54% of respondents said that their customers or clients are interested in purchasing eco-friendly products, “indicating a potential shift in priorities for buyers.” Some 32% of respondents said that their customers have not indicated an interest in buying eco-friendly products, while 13% said they were not sure.

The survey also offered the following insights into consumer financing:

+ Some 53% of those surveyed said they do not offer financing options and do not plan to offer them.

+ 19% said they offer financing options.

+ 15% said they do not offer financing options but plan to add them in the future.

+ 8% had no answer and another 4.5% said they do not offer financing options, but have had customers ask for them or the ability to pay under an installment plan.

For those that do not offer financing options:

+ 30% said their customers are not interested.

+ 27% had no answer.

+ 18% said customers are using other buy now, pay later platforms.

+ 14% said they were concerned about potential non-payments.

+ 11% said they feared that financing options would cut into their bottom lines.

And relating to rising costs for credit/financing:

+ 47% said they were concerned.

+ 31% said they were not concerned.

+ 11% said they were unsure.

+ 10% said they don’t offer financing.

+ 1% had no answer.