If you’ve been scratching your head trying to figure out where the business is these days and, more importantly, where it may be headed based on consumer sentiment and consumer spending, take heart … you are not alone.

According to the latest U.S. Consumer Pulse Survey conducted by McKinsey & Co., consumers, stressed about drivers such as inflation and employment security, are sending signals as mixed as that of the economy itself.

The recent report from McKinsey & Co. notes that while inflation rates are lower than this time last year, they still are more than twice the Federal Reserve’s target, and while layoffs often dominate headlines, the U.S. unemployment rate is relatively low (3.5%) and the labor market remains very tight.

The report goes on to note that, “It’s no wonder, then, that as the U.S. economy continues to send mixed signals, consumers are doing the same. They are worried about rising prices and job security, yet they are still spending.”

Worth noting, however, is that the report found that consumers are switching to less expensive brands to save money, but they are also willing to splurge on certain goods and services.

Specifically, the recent report concludes that, “It is now clear that while consumers increased their spending by double digits from mid-2021 through mid-2022, spending growth has begun to decelerate since late 2022.”

The study also found that while many consumers can spend given their strong balance sheets, they are clearly showing signs of being more selective on what they do spend on.

The takeaway here, according to the McKinsey report, is that companies should not overgeneralize when it comes to examining consumer behavior. Instead, they can tease out nuances and also seek to better understand different types of consumers by generation and income levels, thereby focusing on enhancing the omnichannel experience they offer consumers.

The study, which includes responses from just under 4,000 U.S. adults sampled and weighted to match the general U.S. population, confirmed that working-age Americans are concerned about employment.

The report found that while many high-profile companies are trimming their workforces, there are overall more job openings than before the pandemic. It also confirmed that more than half of the consumers who left the workforce during the Great Resignation are now looking to rejoin it.

Specifically, 2,000 consumers, 52% of 25- to 64-year-olds who quit their jobs during the pandemic and remain unemployed, plan to seek work this year. Some want to find employment because of the increasing inflation-induced cost of living. Others want to work because there’s been a change in their personal circumstances, such as having more capacity to work because their kids have more consistently been back in school as Covid-19 levels have remained low.

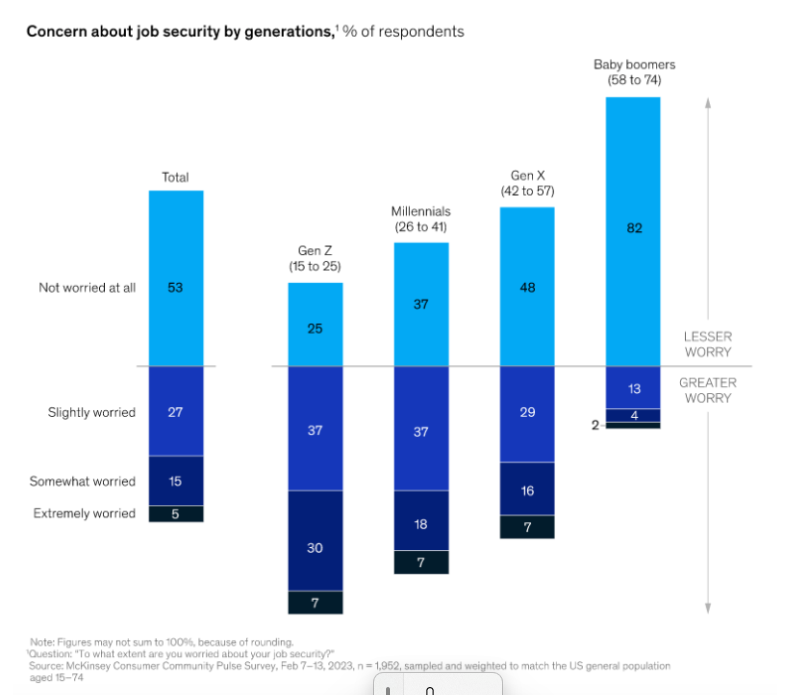

The recent Consumer Pulse Survey results also found that younger consumers are worried about job security, with 74% of Gen Z and 62% of millennials worried about employment. Just over half of Gen X feels the same way. Unsurprisingly, baby boomers, most of whom are likely retired and unlikely to reenter the workforce, are not that concerned.

The McKinsey report, while confirming that consumers are still spending, did note that they are being cautious and often are trading down to less expensive brands. “On one hand, consumers say they are concerned about inflation and are trading down — that is, forgoing a more expensive brand or store for a cheaper one or changing the quantity of what they buy to get the cheapest price,” the report found.

Specifically, 80% of the survey respondents said they’re changing their shopping behavior by trading down, compared with 74% of respondents when McKinsey last asked them in July 2022.

The report also concludes that younger and higher-income consumers, who also are the most optimistic about the economy, are more willing to open their wallets than other age or income groups. “While 88% of Gen Z respondents are trading down, 64% of them are splurging. Gen Z and millennials show a particular willingness to splurge on fashion, with 61% of both age groups saying they intend to treat themselves by buying apparel, footwear and accessories. Groceries and restaurants are popular splurge categories across all age groups,” the report says.

The report also looked at changes in spending by category and found that, while spending on some previously pandemic-accelerated categories, such as home and pet supplies, has slowed down, there are a few categories that have seen acceleration throughout the pandemic, even when adjusted for inflation.

Cosmetics stores and sports apparel and outdoor stores have both seen accelerated sales growth since the summer of 2020. The trends these categories represent — the easy splurge on new cosmetics and the increased prevalence of athleisure dressing — are proving persistent.

In addition, the report also confirmed a continued growth in out-of-home and services-related categories, noting, “Consumers continue to ramp up on travel, embracing opportunities to reconnect with distant family and friends. Travel continues to be one of the fastest-growing spend areas year over year, at 6% even when adjusted for inflation, and is one of the top categories that consumers — especially older and higher-income consumers — plan to splurge on.

“In addition, we have seen a surge in out-of-home entertainment, at 7% year-over-year growth in real dollars. This same level of growth is reflected in the fitness industry, as consumers head back into gyms,” the study concludes.

The report also noted that while consumers flocked to e-commerce sites to purchase during Covid-19, consumers are now shopping in an omnichannel way across the length of their purchasing journeys.

“And it’s not just younger consumers embracing omnichannel shopping. Eighty percent of Gen X and 77% of baby boomers are doing it too. Omnichannel retail is flourishing across all consumer categories, but it is especially popular for discretionary spend, such as toys or home decor, where 70% of consumers have an integrated shopping experience, the report concludes.

by

by