But the pendulum is swinging back

BOSTON — This year marks 20 years since Wayfair founders Niraj Shah and Steve Conine started the multi-billion e-commerce business first known as CSN stores.

And they’re expecting it to be a better year than last year, which moved in a direction the home furnishings giant isn’t really used to — down. Profits and sales were off for both the fourth quarter and the full year, the company reported last week. Total net revenue for the quarter ended Dec. 31 dipped 11.4% to $3.3 billion from the same quarter a year ago, and the net loss was $202 million, or $1.92 per share, compared to net income of $24 million, or 23 cents per share.

For the full year, net revenue decreased 3.1% to $13.7 billion, and the net loss was $131 million, or $1.26 per share, vs. a profit of $185 million, or $1.86 per share in 2020.

Until fairly recently, Wayfair has reported plenty of annual net losses, in fact, all net losses since going public with the exception of 2020, but that full-year revenue dip was something new. If that sounds at all concerning, Wall Street doesn’t seem to share the concern (nor did Wayfair’s executives on the call with securities analysts). Over the three trading days since the announced results, the company’s stock has closed up — 4.7% from Wednesday’s close, another 3.4% Friday and then up more than 7% Monday to finish at $140.87 per share. (I’d like to say this is despite the turmoil caused by Russia’s war on Ukraine, but the stock market, in general, seems to be shrugging that off.)

So what gives? CEO Shah spells it out near the beginning of the call. Last year, he said in so many words, was the year of the furniture store. Physical store retail made a pandemic rebound at the expense of e-commerce. But the tide will start turning again.

Actually, he sees it more as a pendulum.

In 2020, the pandemic “redefined how focused customers are on their homes and shifted how much time they intend to spend there,” he said. Online demand surged, “which allowed Wayfair to demonstrate the true scalability and structural economics of our platform.”

That was 2020. The pendulum ended in favor of the Wayfairs of the world.

“2021 began the normalization process, though the world is still working through the ripple effects of the pandemic,” he goes on. “As countries around the world reopened at their own pace last year, home category growth remained largely resilient, but the pendulum swung back with outsized strength in physical stores as consumers sought to return to old habits.”

Shah goes on to talk about the supply chain disruptions, including the Covid-related factory shutdown and port congestion that “cascaded into global inventory shortages and widespread inflation. Wayfair, he said, has navigated all this, supporting its suppliers and customers along the way, and “we are now leaning in to capture the benefits of returning inventory normalization in 2022.”

And he seemed quite confident consumers who returned to old habits last year are going to swing back to those newer habits. “The primary elements for success in our category have not changed,” he said. “The home is and will remain top of mind, and secular trends favor a durable shift to e-commerce.”

But it doesn’t look like that pendulum has swung back the other way just yet.

At the start of Covid, the pendulum “swung very, very strongly to online,” Shah said in response to a question. “And on our way out of Covid, it’s swinging the other way. We think it’s now coming back towards the middle.”

So far in the first quarter, Wayfair’s consolidated gross revenue on an orders-placed basis is down in the low teens year-over-year, the company said. “Besides the various macro crosswinds, which we are working through today, Q1 also presents a more difficult growth comparison than Q4, with the year ago period bolstered by stimulus early in the quarter and stringent lockdowns internationally,” Chief Financial Officer Michael Fleisher, said on the call.

But moving forward, the company is planning for revenue trends that mirror pre-pandemic curves —more dollars in Q2 and Q3 and then an even bigger Q4 because of the holiday.

“Though it’s early, this is what we’re seeing play out so far in this quarter.”

And even though Wayfair’s sales were down last year, this needs to be put in perspective as Fleisher did at one point during the call. Wafair did $13.7 billion (with a “b”) in net revenue last year. That’s a lot, some 50% more than in 2019, and it did it with a few less people — more than 16,000 globally at the time of the call.

A few more takeaways from the report and call:

Wayfair hasn’t been waiting around for that pendulum to swing back. It has continued to invest heavily in supply chain and logistics “Four years ago, we recognized that there was an opportunity to drive even more efficiency for our suppliers by becoming a digital freight forwarder,” Shah said, creating a logistics solution to reliably and cost effectively get products from where they are made to as close as possible to the end consumer, something, it’s now calling CastleGate Forwarding.

As the industry watched container prices soar last year, CastleGate Forwarding, he said, “offered a safety net for many of our suppliers and moved more than 80,000 20-foot equivalent containers during the year.” This year it expects to roughly double that volume.

Shah said CastleGate Forwarding wasn’t started to solve the industry problem of last year into this year, but to “create value for our suppliers and our customers. The value of this solution will only grow as our scale increases and as we add services over time, such as our domestic break bulk facilities, which began to come online in the last quarter.”

Separately, Wayfair is adding two more U.S. fulfillment centers this year, one recently opened in greater Baltimore and another coming to Chicagoland.

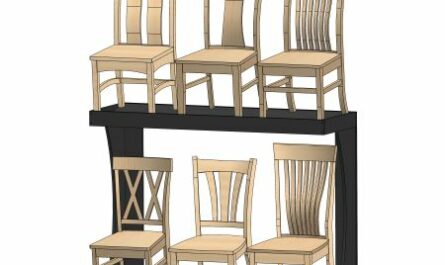

A little more detail on the coming brick-and-mortar store rollout. Wayfair previously said it would open the first three permanent stores — under its AllModern and Joss & Main banners — this year in Massachusetts, the first step in big plans to open stores under all five of its banners through 2023. Shah now says the first stores will be 10,000 to 15,000 square feet, while the Wayfair store format, opening next year will be “substantially larger.”

Stores, he said, will allow the company to further tap into what Wayfair sees as an $800 billion-plus addressable market and offer “valuable avenues for discovery, visualization and marketing, complementing all that we are doing in e-commerce.”

“We have a distribution network,” he said later on the call. “We have a delivery network that can deliver goods very quickly. We have a great offering. We have the inventory for that sitting in the supply chain. We’ve got a very large customer list that we can communicate with. So if you think about building a physical stores network, we basically have everything you need other than the stores themselves.”

And a few more numbers on the way out: In the fourth quarter Wayfair’s active customers decreased 12.5% YOY to 27.3 million. Its 12-month revenue per active customer was up 10.6% to $501 million, and average order value increased to $269 in the quarter from $223.

Wayfair is a terrible online retailer. They deliberately dupe people.

I recently shopped Wayfair to purchase bedding for my granddaughter. I put a comforter set in my cart and the website recommended a sheet set as matching with it, so I bought them as well. When the comforter and sheets came, the sheets not only weren’t the brand and label that was pictured, they also weren’t even the same color. What a scam! The comforter set is a clear girlie pink and the recommended sheet set is a mauve or dusty rose color – not even close. I didn’t even open the plastic packages. The day I received them I processed a return for which I expected Wayfair to pay the shipping because the item they shipped was not what I purchased, so I phoned Customer Service. The customer service representative who spewed rote patter like a twelve-year-old refused to cover the shipping because, without notice, “we sometimes substitute a white label brand” (whatever that means) and you should have looked at more pictures to know that it doesn’t necessarily have to be a match.”

“But you recommended to me that IT IS a match” I argued, to no avail…

I get it – Buyer BEWARE! They pawned some crap off on me and got away with it because they already have my money. Now I am having to pay $30 in shipping fees to return two bedding items that do not coordinate and which I should never have tried to purchased from Wayfair – life’s lessons… I will not make that mistake again,

But now I know Wayfair’s game and EVERYONE SHOULD BEWARE – the merchandise they “recommend” to go with a purchases is a slimy deal – it’s how they get rid of crap. Once you have it and even if it is not as represented, they say, “well, we can do that” and you’re stuck.

Amazon would never do that to a customer. That’s why they’re killing it.

Shop Amazon.