Core strategies include increasing brand awareness, expanding its physical store footprint and using technology to build its omnichannel platform

BOSTON HEIGHTS, Ohio — A glance at Arhaus’ annual investor presentation once again shows the multilayered, omnichannel nature of the lifestyle retailer’s business.

It also offers a window into the growth opportunities it sees in the various channels, from its expanding network of brick-and-mortar stores to its expanded footprint in e-commerce.

Driving both segments along with its catalog and other marketing segments, is its custom business, both for designers and their clients and other consumers seeking products they can tailor to their own wants and needs.

To drive growth and build market share, the company has identified several core strategies that include increasing brand awareness, expanding its physical store footprint and using technology to build its omnichannel platform.

Brand awareness is obviously achieved on multiple fronts, including through direct mail, digital advertising, social media and new product initiatives.

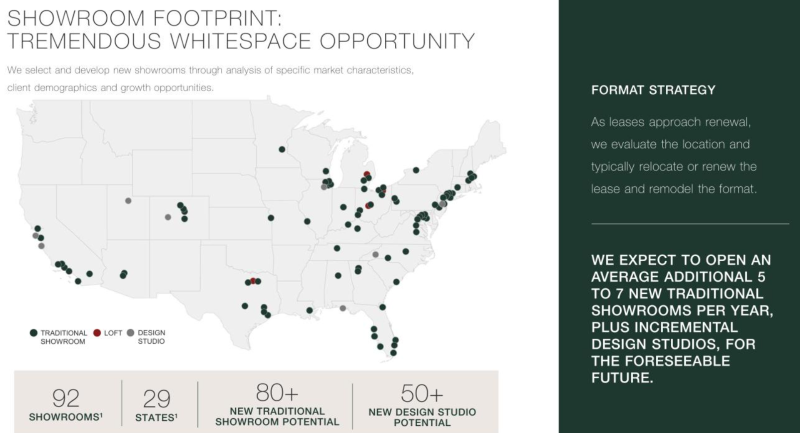

However, its physical showroom footprint remains key as many of its stores averaging about 16,000 square feet are in major and/or expanding markets. As of Dec. 31, 2023, it had 92 showrooms in 29 states, including the eight stores it opened last year in California, Connecticut, Massachusetts, New York and Florida. Last year, it also opened two new design studios averaging around 5,000 square feet in North Carolina and Illinois and a Loft Outlet location in Texas.

With a team of 110 in-home designers in 78 showrooms by year-end 2023, the company is able to not only cater to the needs of individual clients, but also increase average order values by as much as four times that of a standard order. By offering similar design services, retailers such as Bassett, Haverty Furniture and Ethan Allen are also increasing their average tickets.

This year, Arhaus plans to open nine to 12 new showrooms, including four to six traditional stores, two to three design studios and three new Loft Outlet locations. These additions bring it closer to an end goal of having more than 165 traditional showrooms and more than 50 Design Studios.

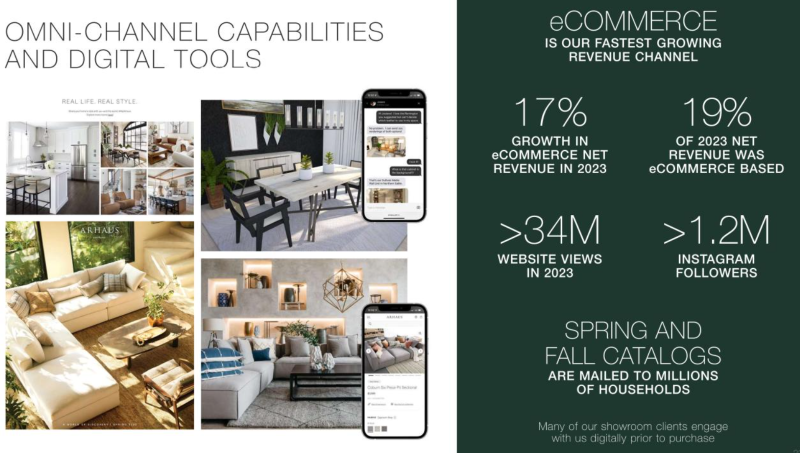

But this is only one way the company said it is increasing market share. In its report, the company said that e-commerce is its fastest-growing channel with a 17% increase in net e-commerce revenues in 2023. In addition, 19% of its $1.3 billion in net revenue was e-commerce based. By comparison, it had a 43% increase in e-commerce revenue the year before, with 17% of its overall revenue being e-commerce based.

Its website views also totaled 34 million last year, the highest in the past several years and nearly three times its 12 million views, pre-pandemic, representing an annual compound growth rate of 30%, according to the report.

While falling short of the estimated 43% of net revenue from e-commerce revenues reported by its peers, the retailer appears on the right path to be able to grow this part of its business in the coming years. And all the while without compromising the importance of its brick-and-mortar stores, whose presentation it describes as “theater-like” in their ability to capture the consumer’s attention and imagination of what the settings will look like in their homes whether they’re purchasing on their own or working with an experienced designer.

In fact, the aggressive growth in physical stores should only boost e-commerce revenues and designer business as its customers learn the different ways they can purchase.

But a key message in its presentation is that all segments are key to the growth of its business moving forward as they contribute to top-line sales and profitability. How the company’s business plays out as consumers place a renewed emphasis on their homes again — hopefully in the near future — will be one of the retail stories to watch in the months and years ahead.