However, the company remains profitable with net income of $13 million during fiscal 2024 3rd quarter ended March 31

DANBURY, Conn. — Ethan Allen Interiors reported double-digit decreases in sales during its fiscal 2024 third quarter ended March 31, as consumers continue to pull back their furniture purchases, causing an ongoing slowdown at retail.

It reported consolidated net sales of $146.4 million, down 21.4% from the $183.3 million during the same period last year. It experienced its biggest drop on the wholesale side of the business, with net sales of $89.8 million, down 21.3% from the same period last year. Sales on the retail side of its business were down 18.8% to $122.6 million.

However, the company remains profitable, with net income of $13 million, or 50 cents per share, down from $22.3 million, or 87 cents per share the same period last year. Consolidated gross margin was 61.3%, up 140 basis points from last year, which the company attributed to a change in its sales mix, lower manufacturing input costs and reduced headcount, partially offset by lower unit volumes and higher sales of designer floor samples.

Meanwhile, its adjusted operating margin declined to 10% compared to 15.2% last year. This was related to fixed cost deleveraging from lower consolidated net sales and partially offset by gross margin improvement, lower headcount, less variable expenses and other cost savings and operating expense controls.

The company said it ended the quarter with 3,448 employees, which was down 9.6% from last year and down 32.7% from March 2019.

It also said it reduced inventories during the quarter by 4.7% to $144.5 million as of March 31, compared to $149.2 million as of June 30, 2023. “Inventory balances continue to decline as the company aligns its inventory with incoming order trends while also ensuring appropriate levels are maintained to service customer orders.”

The company said that customer deposits from undelivered written orders were $80.5 million by the end of the quarter, compared with $77.8 million as of June 30, 2023. Its wholesale backlog was down 21.3% from a year ago, to $57.7 million, reflecting “historical norms and pre-pandemic levels.”

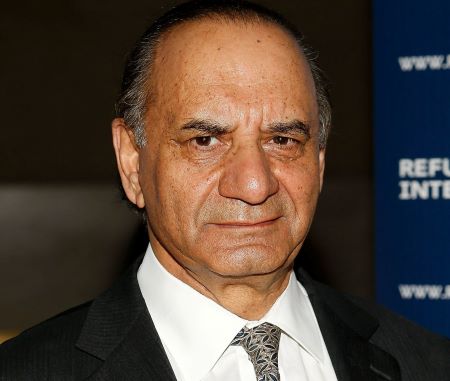

“We are pleased with our financial performance and the continued strengthening of our enterprise,” said Farooq Kathwari, company chairman, president and chief executive officer. “We are also seeing incremental consumer interest returning back to the home after being previously diverted to other areas such as travel.”

Other highlights of the report were as follows:

+ The company said written orders on the retail side of the business decreased 8.6% during the quarter while wholesale written orders decreased by 14.6%.

+ Advertising expenses during the quarter equaled 3.4% of net sales, up from 2.2% in the prior-year period. The company said this was largely because of additional direct-mail campaigns. “Promotional activity remained disciplined and consistent with a year ago,” the company said.

+ It also reported generating $23.7 million of cash from operating activities, compared with $33.4 million last year.

+ It said it ended the quarter with $181.1 million in cash and investments with no debt, compared to $172.7 million as of June 30, 2023, and $25.7 million during the pre-pandemic third quarter ended March 31, 2019. The company said the increase during the current fiscal year was primarily due to $54 million in cash generated from operating activities and partially offset by $40.3 million in cash dividends paid and capital expenditures of $7.5 million as “the company continued to return capital to shareholders and reinvest back into the business.”

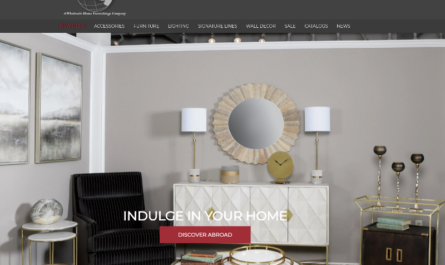

Of the company’s various activities of late, Kathwari said, “We have launched a number of important initiatives including strengthening of our talent, introduction of new products, stronger marketing campaigns, continued investments in our North American manufacturing, which make about 75% of our furniture, and our logistics network providing white-glove delivery service to our clients at one cost throughout North America.”

He added that “combining technology with its interior design talent has been a game changer, including introducing and implementing our important initiative as a leading Interior Design Destination, which elevated a consistent level of presentation across our retail network.”

“While there are current economic challenges and international conflicts, we remain cautiously optimistic,” he added.