46% of those surveyed prefer minimalist styles, followed by modern farmhouse, coastal and midcentury modern

HIGH POINT — As retailers and designers are in town for the High Point Market the next several days, we saw it fitting to address some of the preferred design trends among consumers as reflected in our latest round of Consumer Insights Now research published earlier this week.

Sponsored by Synchrony, this and related rounds of research involved a survey of some 1,818 U.S. consumers. Representing a mix of men and women ages 18-74 along with a mix of generations, ethnicities and household incomes, these consumers said they planned to buy one or more home furnishings products in the first half of 2024.

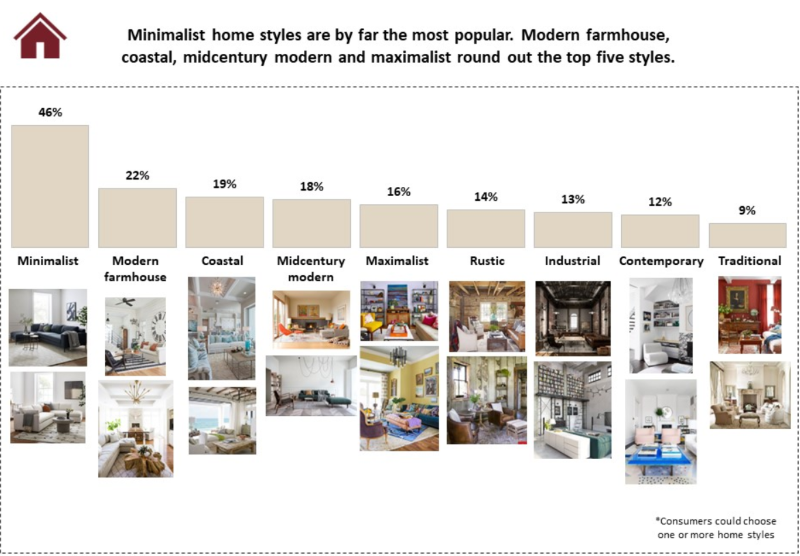

It is worth noting that some 46% of those surveyed favor minimalist styles, followed by modern farmhouse, 22%; coastal, 19%; and midcentury modern, 18%. There obviously is some crossover here as another 16% said they prefer maximalist styles, followed by rustic, 14%; industrial, 13%; contemporary, 12%; and traditional, 9%.

A majority — between 42% and 46% — of younger consumers ages 18 through 43 preferred minimalist styles, which is described as simple forms, natural colors including gray, white and black tones, along with a lack of excess ornamentation. While this might involve wood furniture in natural wood tones or finishes, and upholstery in neutral fabrics, it can also include some color as long as it appears consistent in its execution, primarily using one color that ties various items together within a single collection, for example.

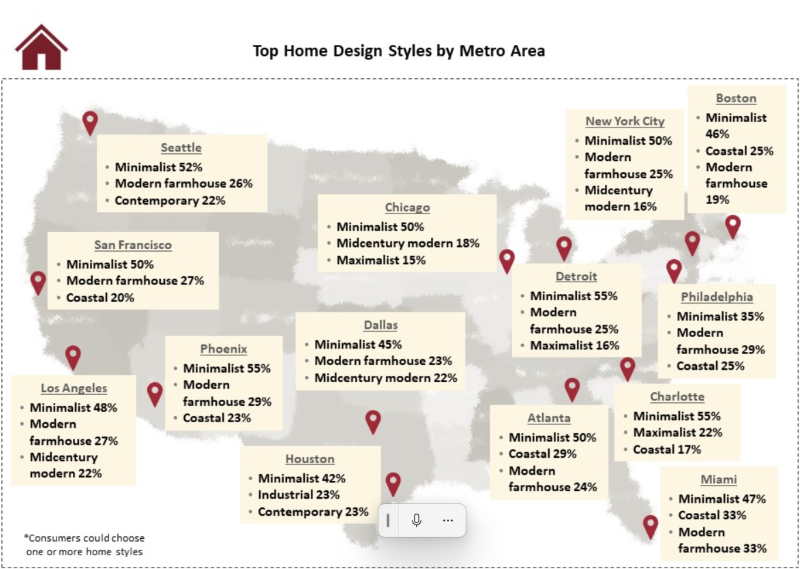

However, the style also was favored by an even higher percentage of older consumers, including baby boomers ages 60 and up, 46%, and 49% of Gen X consumers ages 44 through 59. Also worth noting is that it was the top style preference among consumers surveyed in 14 metro areas, ranging from New York, Philadelphia and Boston to Dallas, San Francisco and Los Angeles.

In bringing their furnishing plans to life, some 57% said they plan to design their spaces on their own, with numbers skewing higher among older consumers and slightly lower among younger consumers, who appear more open to using an interior designer. Overall, 6% said they plan to work with an interior designer in 2024, including those under age 44, and with incomes of $100,000 or more. They also tend to be homeowners with children at home and have good to excellent credit scores.

The reasons they cited include the following:

+ “Design professionals have expertise in furniture selection, design principals, color and space planning.”

+ “Designers help you choose a different design that fits your needs.”

+ “I prefer the opinion of experts.”

+ “Designers create a cohesive and aesthetically pleasing space.”

+ “To make my house more appealing.”

+ “To maximize the potential in my home.”

+ “Because I’m bad at designing.”

+ “To take the guesswork out of it all.”

Still, some 59% of those surveyed said they want to be completely involved in the design process as they enjoy the idea of collaboration and coming up with designs together with a professional. Of the remainder, some 38% said they would like to be a little involved and 3% said they did not wish to be involved at all.

Those using a designer expect to pay about $9,000, although that could vary depending on the rooms being furnished.

The survey also offers a closer look into the type of home consumers own (house, condo, townhome) and whether they live in an apartment or some other type of rented unit. It also provides insights into when they moved into their home and whether they plan to add onto or renovate their home in the coming year or two. Nearly half of older and younger millennials plan to add on to their homes in the next year or two while baby boomers and Gen Xers are the least likely to add on to their homes.

As always, we hope this information proves useful, particularly for buyers heading into market. Note that a separate part of the research looks at the importance of sustainability, which we will take a closer look at next week.

Here is an overview of what topics CIN has covered so far and what’s to come in our last installment coming on Monday April 15.

+ March 11 — CIN Overview into Planned Furniture Purchases for the First Half of 2024

+ March 18 — Sofa and Sectional Buying Plans

+ March 25 — Occasional Table Buying Plans

+ April 1 — Mattress Buying Plans

+ April 8 — Home Design and Sustainability

+ April 15 — Furniture Shopping Plans