If the latest report from McKinsey’s ConsumerWise research is on the mark, we may have turned the corner, at least as far as consumer confidence is concerned.

According to the authors of the most recent ConsumerWise update, consumer confidence hit its highest level in almost two years and as we know, healthy levels of consumer confidence often translate into healthy levels of consumer spending.

Specifically, the McKinsey report concluded that concerns last month about inflation decreased slightly from the previous quarter, which helped consumer optimism about the U.S. economy reach its highest level in almost two years.

Even so, the report pointed out that even though most consumers reported feeling less stressed to save money for a rainy day, 20% were still pessimistic about the economy, despite that number representing the lowest reported pessimism rate since June of 2022.

Looking at key drivers that sparked consumer optimism, the report pointed to an end-of-year stock market rally and some signs of price stabilization. The report also said that consumers are feeling more optimistic because of perceived labor market resilience and historically low unemployment.

As a caveat, the report noted, “Despite the improved macroeconomic outlook at the beginning of the month when our survey was conducted, more recent inflation data show consumer prices are still climbing at a rate higher than the U.S. Federal Reserve’s inflation target. Given that nearly half of consumers still cite inflation as a major concern, consumer optimism next quarter may fluctuate based on these new data points.” Worth noting, the report said that consumers confirmed plans to increase spending of essential items, including fresh produce, meat and dairy and “center-store categories” (which include the items one might expect to find in the center of a grocery store, such as shelf-stable foods or frozen foods).

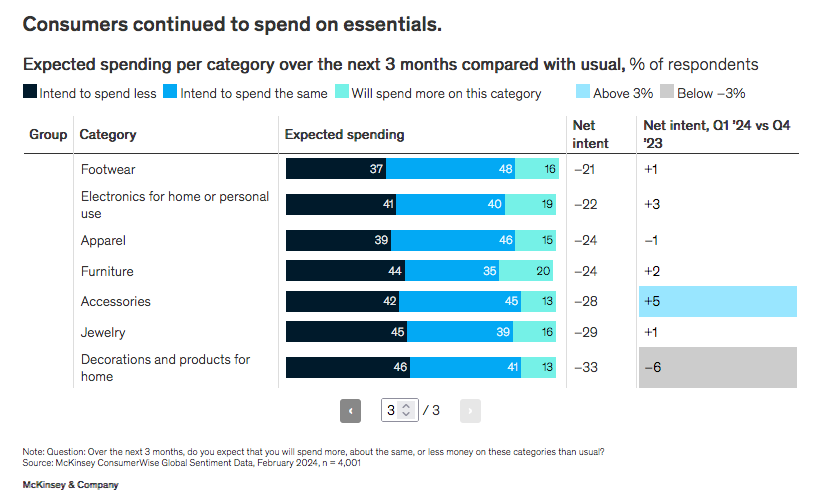

And, as expected, a spending focus on essentials such as food and utilities means less of a spend of discretionary items such as furniture. As the chart indicates, expected spending on furniture between February and April is projected to be down according to 44% of the respondents. Another 35% said spending would be the same with the remaining 20% saying they intend to spend more on the category.

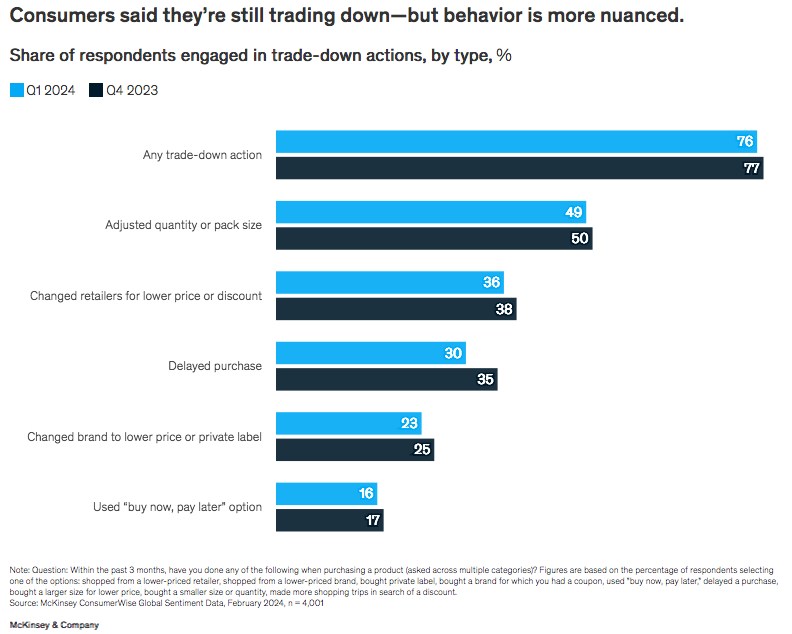

Concern over inflationary-driven price increases has resulted in consumers continuing the trend to trade down.

Specifically, the report noted that trading down — or changing the type or quantity of purchases for better pricing and value — was still prevalent among consumers in February, although slightly fewer consumers reported trading down compared with the end of 2023.

The report also confirmed that younger shoppers traded down more than older consumers and that low- and middle-income consumers traded down more than high-income consumers.

Fewer consumers reported switching to lower-priced retailers and brands in February compared with the end of last year. The reported use of “buy now, pay later” services plateaued in February, and fewer consumers said they delayed a purchase in the past three months.

What all of this may mean to the upcoming April market still remains to be seen.

As we go to press, it seems that while consumer confidence may be on the rise, spending on our category still has a ways to go before it catches up.

by

by