HIGH POINT — Sales growth for all retail beat e-commerce sales in 2021, the Department of Commerce reported last month. That may come as a surprise to some, but when you stop to think about it, it makes a lot of sense.

Still, count a New York Times technology reporter among those expressing surprise that “Americans spent 18% more on food, cars, furniture, electronics and other retail products last year compared with 2020,” while online retail sales increased just 14%.

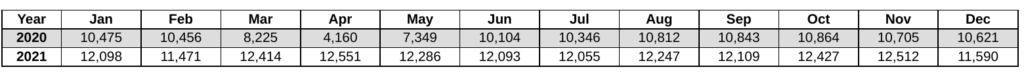

Even more interesting (at least for us): furniture stores did even better than overall physical stores, according to DOC monthly sales reports. The data doesn’t square perfectly with the latest quarterly and full-year e-commerce report, but we’ll get to that in a bit. For now, take a look at these sets of seasonal adjusted sales number, first for the furniture and home furnishings sector:

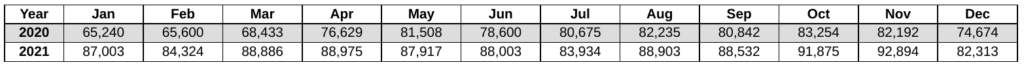

And here’s the comparable results for a sector the government calls nonstore retailers:

If you add up the 2021 sales for furniture and home furnishings stores, you get $145.85 billion. That’s a 26.9% increase over the year before. Nonstore retailers did $1,054 billion for a $14.5% increase over 2020. The thing about the nonstore sector as reported is that it includes catalog companies and the like — more than just e-commerce retailers. In the DOC report released most recently, which appears to be pure-e-commerce, the government says total online sales for 2021 were up 14.2% to an estimated $870.8 billion.

Either way, brick-and-mortar stores outperformed with a growth rate nearly double that of e-commerce or nonstore retailers.

And here’s why that shouldn’t be so surprising despite all we’ve been hearing about the consumer’s steady migration to online shopping. It’s not that they’ve headed back to stores because they had a change of heart so much as a change of life plans. In fact, it’s been two pandemic years of changing plans, and the retail landscape changed with those plans, too. Take another look at the furniture store numbers above and you’ll see a big dropoff that comes in March, April and May of 2020. All of a sudden, the industry went from more than $10 billion a month to a little more than $8 billion in March, then just over $4 billion in April before creeping up to $7.3 billion then back up to more than $10 billion for each of the remaining months of the year.

The good times rolled for furniture stores through 2021 with more than $12 billion in sales every month except February and December. The comps were easier. The spring 2020 Covid shutdowns basically set the table for a killer 2021.

Nonstore retailers, meanwhile, saw big sales spikes in April and May 2020 followed by mostly incremental growth after that. They never really had a bad month in 2020, so the decent growth in 2021 is just that — decent.

Another thing worth mentioning is the transformation furniture retailers went through during the pandemic. How many times have we heard about how Covid only accelerated e-commerce plans and business of brick-and-mortar retailers. Those stores that weren’t participating in online commerce in April 2020 were dead in the water with the shutdown. They either figured it out quickly, hung in there for a few months during the shutdown, or they perished. Most got even better at e-commerce.

And so some of the furniture store sales growth we see in 2021 is likely online sales reported as physical home furnishing store sales. I doubt any of the retailers filling out their government forms were excluding their online business. I’ve looked at the form; there’s no opportunity to break it out.

Regardless, it’s clear physical furniture stores had a much better 2021 than their e-commerce-only counterparts, as consumers ventured into the real world again and/or bought more goods online — from both brick and-and-mortar retailers and pure-play e-commerce companies.

Look no further than Wayfair’s fourth quarter and year-end results to see how the challenge for online businesses was real. The home furnishings e-commerce giant posted its first down sales year since going public. As CEO Niraj Shah put it, “As countries around the world reopened at their own pace last year, home category growth remained largely resilient, but the pendulum swung back with outsized strength in physical stores as consumers sought to return to old habits.”

What all this means for the future of physical retail is hard to say. Wayfair may have had a down year, but it also posted total revenue of nearly $14 billion — not too shabby. And Wayfair branded physical stores are on the way.

The takeaway, I suppose: Despite all the supply chain troubles, the pandemic breathed fresh life into a sector that, in some cases, was starting to limp along, sometimes ignoring the online threat, sometimes embracing digital, but forced to chase a fast competitor with a head start.

The playing field has been leveled for those who bring their best game.