Many surveyed by SAP SE believe their supply chain needs improvement and see issues lasting until late summer 2023

It had to be more than a decade ago when I asked City Furniture’s Keith Koenig what made him so successful as a furniture retailer.

Keith looked at me for a moment, then said something I will never forget. “I’m really not in the furniture business. I am in the logistics business and the things in the boxes just happen to be furniture.”

Obviously, as one of the nation’s leading home furnishings retailers, City Furniture most definitely is in the furniture business. But Keith’s point was telling — without a seamless supply chain as their foundation, companies may end up chasing profitability the way puppies chase their tails.

Nothing has taught us that lesson as harshly as the pandemic. While some of the related supply chain challenges — congested ports, skyrocketing prices of containers, transportation issues and raw material prices — are mitigating, many observers, including SAP SE, believe commerce could be hampered by supply chain issues until the end of summer 2023.

In fact, SAP SE, one of the world’s leading producers of software for the management of business processes, developing solutions that facilitate effective data processing and information flow across organizations, recently conducted a survey of 400 U.S.-based senior

decision-makers in logistics and supply chain strategy across small, medium and large businesses.

Specifically, the study found that just over half (52%) of those surveyed think their supply chain still needs much improvement and nearly half (49%) expect current supply chain issues to last through the end of 2022. One in three says the issues will last until the end of summer 2023.

Here’s why:

Political Unrest Worldwide Causing Current Supply Chain Problems

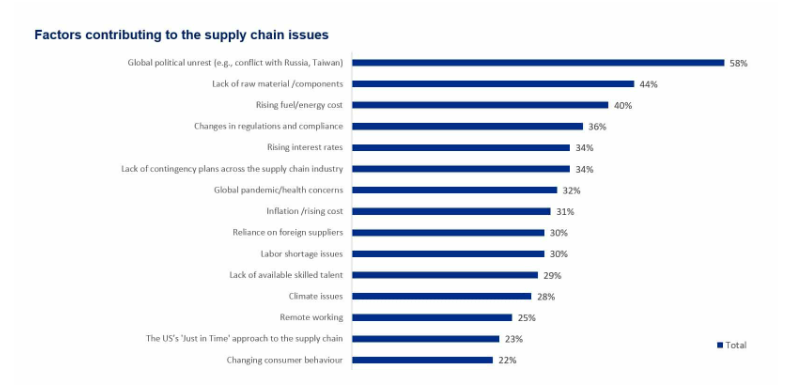

Business leaders say their current supply chain issues primarily stem from global political unrest (58%), lack of raw materials (44%) and rising fuel and energy costs (40%). Only 31% cited inflation as a major contributor.

When asked to cite the causes for future supply chain problems in 2023, the respondents cited:

+ Reduced availability of raw materials in the United States (50%)

+ A slowdown in construction of new homes (44%)

+ Disruption to public transport due to lack of drivers (44%)

The group also reported that companies were caught off guard by the rapidly changing shifts in consumer buying patterns during the pandemic and suffered financially as a result. The survey said that about half of the business leaders polled reported seeing some negative

financial impact from supply chain issues at the start of the pandemic, including:

+ A decrease in revenue (58%)

+ Necessity to take new financing measures, such as business loans (54%)

+ Inability to pay employees (50%)

+ Missed rental payments (42%)

As a result, and as a means of the extra costs of supply chain issues, more business leaders say they’ve had to turn to wage or recruitment freezes (61%) and staff job cuts (50%). Of interest, only 41% of the respondents reported having opted to increase the price of their products or services.

Supply Chain Issues and the 2022 Holiday Season

Obviously, consumer shopping patterns will determine the fate of retail. With that in mind, a separate study by SAP of 1,000 U.S.-based consumers found that nearly half (45%) say price is the top factor they weigh in purchasing decisions, and an overwhelming 73% say it’s a top three factor.

The study determined that worries about ongoing inflation and the threat of a recession prompted the majority of consumers polled — 65% — saying they plan to decrease their holiday spending budget, and another 54% indicating that they expect inflation to impact how they shop for holiday gifts, with 39% shopping online more.

Incidentally, most business leaders, 73% in anticipation of that spike in online shopping, said they are expecting an increase in e-commerce volume this season compared to last year.

To sell their own products, business leaders said they plan to deliver on these differentiating points:

+ Speed of delivery (64%)

+ Excellence of customer service (57%)

+ Availability of products (52%)

+ Sustainability credentials (47%)

+ Price reductions (42%)

+ Made in the U.S. (38%)

Firms Firming Up Supply Chains

Respondents that said their supply chains needs improving said they plan to do the following:

+ Adopt new technology to overcome challenges (74%)

+ Implement new contingency measures (67%)

+ Prioritize U.S.-based supply chain solutions (60%)

+ Find new environmentally friendly supply chain solutions (58%)

Worth noting is that the vast majority (64%) of businesses polled said they are or will be moving from a “just in time” supply chain to a “just in case” supply chain by increasing the amount of inventory they store. In fact, 63% think the United States should adopt this approach to overcome potential supply chain crises this year.

“The move to ‘just in case’ means organizations will be storing more inventory to help meet customer demand, but doing so also means increased cost,” said Scott Russell, a member of the executive board of SAP SE, Customer Success. “Managing the supply chain is a constant balancing act. Over the last couple of decades, the ‘just in time’ approach traded resiliency for efficiency and lower costs, which in turn made the supply chain fragile. The pandemic and the snowball effect of related disruptions exposed this fragility, which has organizations refocused on resiliency. Still, cost remains a factor, especially in the current economic environment. Technology can help organizations strike the right balance by enabling more real-time collaboration between trading partners.”

For more information about SAP, interested parties can visit sap.com/businessnetwork.

by

by