Consumers are seeking living room pieces that will coordinate well with their new sofa or sectional

HIGH POINT — With upholstery being the No. 1 category that’s top of consumer’s furniture wish lists for the first half, it comes as no surprise that occasional tables are also a major product segment of interest.

Sponsored by Synchrony, our research indicates, 36% of consumers surveyed plan to buy some type of sofa, sectional or other seating for the living room between January and June.

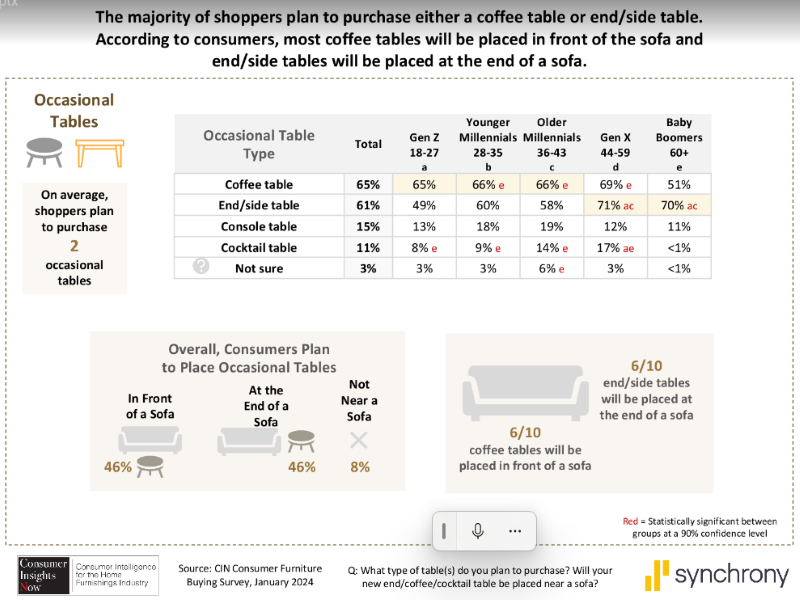

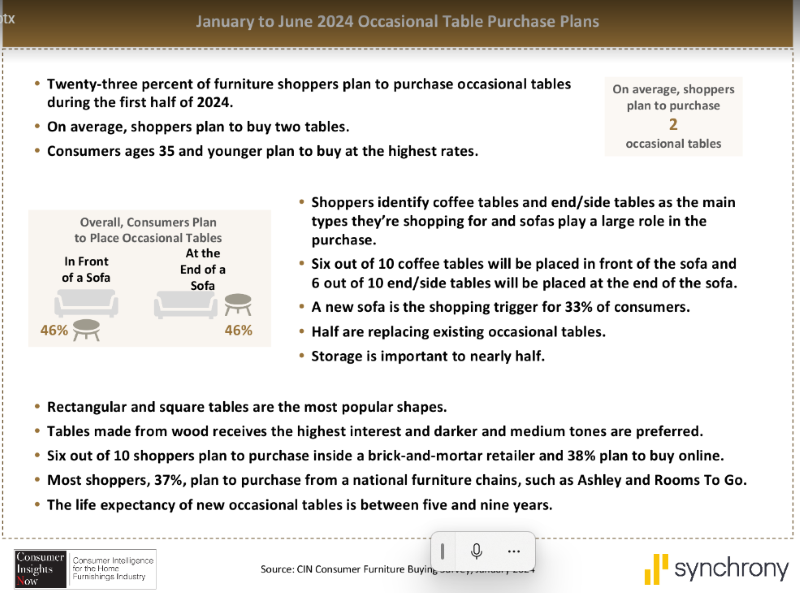

Although a runner-up to area rugs (29%), decorative accessories (25%) and mattresses for the primary bedroom (24%), occasional tables rank in the Top 5 items of interest, with 23% of those surveyed planning to buy something in the category from January through June of this year.

Of course, like upholstery, the SKU variation in occasional tables is wide, with items ranging from cocktail and end tables, to consoles or sofa tables and accent tables in various shapes and sizes. They also offer storage and other types of functionality to address the needs of today’s consumers.

The popularity of the category also lies in the fact that many pieces can be purchased and taken home that day, creating a cash-and-carry option for stores looking for quick sales and turns on their floor, particularly for those wanting to buy a new set of tables to go with their new sofas or sectionals.

Our research included some 1,818 consumers across a mix of males and females ages 18-74 representing a mix of generations, ethnicities and incomes. Those surveyed on average plan to buy two tables, identifying cocktail and end tables as the main areas of interest. Again, the purchase of a new sofa is the main trigger for a third of those surveyed as a majority plan to place the cocktail in front of a sofa and an end table on the side.

No surprises there, of course, but the research offers other insights that the industry may find useful.

+ Half of those surveyed are replacing existing occasional tables and a third are buying to coordinate it with a new sofa or sectional.

+ Availability and quick delivery along with storage are important to nearly half of those surveyed.

+ Tables made of wood received the highest level of interest, with consumers preferring darker or medium wood tone finishes.

+ However, 73% of those surveyed also preferred some type of mixed media elements on their table selection.

+ Rectangular shapes were preferred by 45% of those surveyed, followed by square (40%), round (23%) and oval (17%).

+ Consumers’ life expectancy of their new occasional tables is between five and nine years.

+ 78% of the tables purchased will be for a living room while the remainder will place them in a family room or den.

Other areas covered by the survey include specific wood tone preferences, consumer preferences of legs versus pedestal bases and other configurations of interest beyond the typical rectangular, round, oval and square shapes.

In addition, the survey found that 62% of those surveyed planned to buy a table in-store and 38% planned to make their purchase online, including a large number of younger customers, those living in an apartment and those earning under $50,000. Those wanting to purchase in-store, include older millennials, Gen X and baby boomers, as well as empty nesters. They also live in a house and have incomes of $50,000 or more.

For those looking to buy in-store, some 37% said they were looking to buy at a national furniture chain (think Rooms To Go or Ikea), while 16% said a big-box retailer. This was followed by 14% who identified a local furniture store, 12% who said Amazon and 7% who said Wayfair.

The majority (38%) of consumers surveyed also are looking to spend between $100 and $299 for their table (note that the lower end of the spectrum could include a decorative accent or drink table), while another 24% said $300 to $499 and 13% said $500 to $999. Some 17% said they were looking to spend under $100, which again, would put them in the market for a second-hand accent table, or perhaps a few-month supply of printer ink or a few-month supply of paper towels.

Of the total, nearly 80% of those surveyed plan to pay in full at the time of purchase and 15% were planning to make monthly payments over a period of time. In addition, some 58% plan to purchase with a credit card and 29% plan to pay with cash.

Worth noting are the style, materials and in-store versus online buying preferences of younger versus older consumers. Such data will be of interest to wholesalers and retailers alike that are looking to sell to a younger generation of consumers. That said, there is a pretty big market for the category and plenty of resources that offer the types of products consumers are looking to purchase in the next few months.

As always, we hope the industry uses the data to its advantage and that it comes in handy, particularly during the spring market cycle as many of the consumers surveyed will also be in the market for the rest of the year should they not make their purchases in this current six-month window.

Below is a schedule of previous and upcoming Consumer Insights Now reports.

+ March 11 — CIN Overview into Planned Furniture Purchases for the First Half of 2024

+ March 18 — Sofa and Sectional Buying Plans

+ March 25 — Occasional Table Buying Plans

+ April 1 — Mattress Buying Plans

+ April 8 — Home Design and Sustainability

+ April 15 — Furniture Shopping Plans