With highly sharp prices already, the retailer’s value proposition will also need to offer quality and durability, both of which remain important to today’s consumers

WINSTON-SALEM, N.C. — Having been to Big Lots plenty of times in recent years, it’s my impression that the retailer has always offered strong values, including in its furniture mix.

The stores also are well organized, clean and thoughtfully merchandised across product segments. I’m guessing other stores outside the Piedmont Triad area of North Carolina that’s home to High Point offer a similar experience.

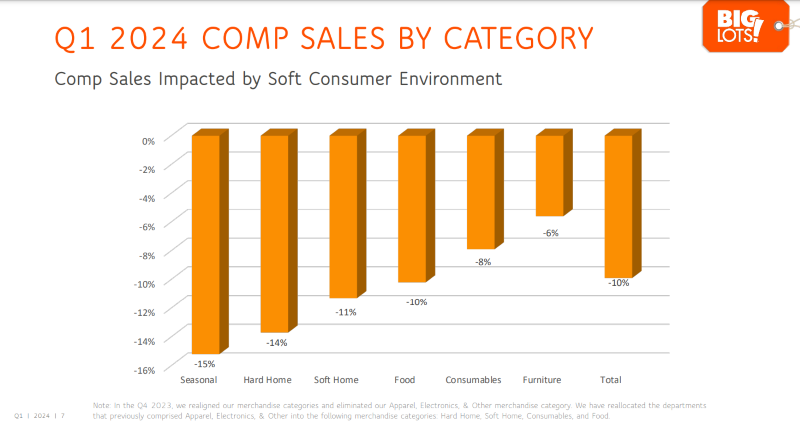

Nonetheless, the economy, following a relatively strong holiday season for the retailer, hasn’t cooperated much at least during its fiscal first quarter ended May 4. Net sales were down 10.2% to $1.01 billion, from $1.12 billion the same period last year, driven largely by a 9.9% comparable sales decrease.

Now based on what we’re hearing in the furniture industry, that’s not a huge drop given some reports of year-to-date decreases topping 20% in the furniture sector. The declines no matter how large or small, are affecting just about everyone in the industry, from suppliers of hardware, equipment and raw materials to finished goods at the wholesale and retail level.

But Big Lots has been in a bind because it attracts value seekers across product categories. And many of these consumers are already struggling because of the cost of everyday expenses ranging from food and gas to utilities and health insurance. It’s why the lower-middle segment is probably suffering more than the upper middle and upper end of the business, where consumers tend to invest on things of value like furniture and other décor for their home.

But Big Lots appears to be headed toward even sharper values moving forward, including in the furniture segment. In its latest conference call, executives mentioned the term closeout more than a dozen times, noting that it is part of the extreme bargain positioning the company will continue to increase throughout the sales floor.

“The penetration of those extreme bargains is happening across all our categories,” noted President and CEO Bruce Thorn, adding, “We’re also seeing the extreme bargain penetration we have with our Broyhill and Real Living lines in upholstery actually go to positive comps…And that’s accelerating into Q2.”

Furniture remains the largest category by far, representing some 29% of sales in the first quarter, according to the company’s latest investor presentation. As seen in the illustration above, it also was the area that saw the lowest overall decline in sales — down 6% compared to seasonal, down 15%; soft home, down 11%; and food, down 10%, to cite a few key areas of the business.

But the term closeouts can have a negative impression in home furnishings, a fashion industry where customers tend to look for the latest styles albeit at value price points. Yet for the consumer who’s strapped for cash and seeking the best prices possible, the term closeout probably has huge appeal and thus could spur further interest and spending.

As Big Lots continues to sharpen its price point and value proposition, another consideration will be quality and durability. Appealing to families, particularly with its toy and seasonal departments, Big Lots’ durability story will be key as consumers likely spending hard-earned dollars won’t want to be replacing their newly acquired furniture anytime soon.

This is particularly true in upholstery, one of its strongest categories, yet one that also tends to get used and abused the most by kids and pets and, in some cases, adults, depending on what they’re doing in their living room.

So, at best, it’s going to be a balancing act that will involve several things, including price, but also the styling, construction and durability. This applies not just to indoor products, but also the outdoor category, where Big Lots also has a strong selection.

Yet during the call, Thorn indicated that the strategy already appears to be making headway, perhaps most notably in furniture — as seen in the strong comps — but other areas, too.

“We remain focused on managing through the current economic cycle by controlling our controllables,” he said. “Our operational initiatives to offer a large assortment of new and exciting extreme bargains, cut costs, and increase productivity, exceeded our targets in Q1. This enabled us to improve consumer perceptions about our brand and the value we offer and to deliver a year-over-year improvement in gross margin rate and operating expenses, despite the significant sales pressure this quarter.”

However, he noted there is room for improvement, which the company is pursuing through a stronger business model the retailer has created through five key actions that are expected to result in better results, most notably in the second half. These include 1) own bargains 2) communicate “unmistakable value” 3) increase store relevance 4) win customers for life through its omnichannel efforts and 5) drive productivity.

“We are confident that the five key actions are putting us on the right path to turn around our business, though we still have a lot of work ahead of us,” Thorn said.