A recent study on inflation and consumer spending found inflation is causing consumers to cut spending on nonessential items, including home furnishings, and to opt for cheaper products to preserve their standard of living.

The report from PYMTS Intelligence, a leading global data and analytics platform, is the 18th installment in the firm’s “Consumer Inflation Sentiment” series. It gathered its findings after surveying 2,309 U.S. consumers between Dec. 5, 2023, and Dec. 19, 2023, to better understand their reactions to continuous price hikes.

The study, which concluded that rising prices have prompted many consumers to adjust their purchasing habits, also found that inflationary pressures across the economy have eroded consumer purchasing power and directly affected demand. Specifically, 62% of those polled have cut down on nonessential spending because of increases in retail prices.

More importantly, consumers are leaning toward cheaper retailers, lower-quality products and even secondhand retailers.

As a means of cost-cutting, the study also indicated that shoppers, including affluent shoppers, are trading “what’s new” for what looks good and is affordable.

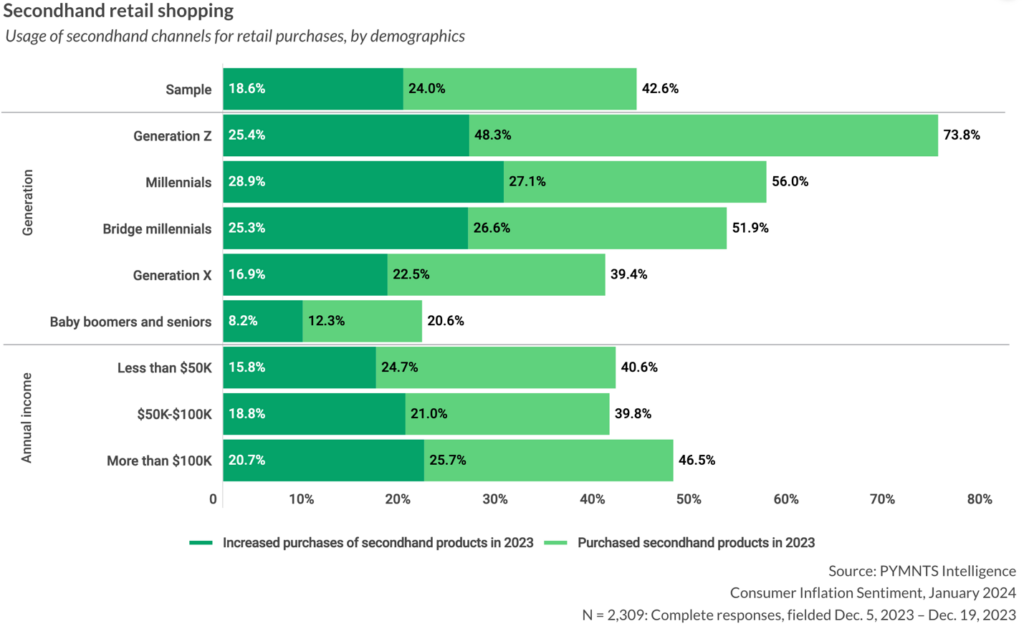

The demand for cheaper items in response to higher prices has led to a shift in consumer sentiment regarding secondhand retail. Survey data shows that 43% of consumers purchased a secondhand product in 2023, with high-income consumers the most likely to make such purchases. In addition, 19% of consumers said they have made more secondhand purchases.

This share rises among younger and more affluent consumers. High-income consumers are less likely to use secondhand channels for clothing. They are more likely to use them for furnishings and electronics and to have used a variety of secondhand channels, particularly social media, and secondhand marketplaces.

On the other hand, the average secondhand apparel buyer tends to be older and have a lower income.

When the authors of the study did a deeper dive into the responses, they said, “We see an interesting story of how consumers deal with specific purchases. The sale of durable goods shows a strong example. Retail sales reached their highest point in real terms in 2021, suggesting that, at least for items that are considered durable, consumers made purchases that are not likely to be repeated for a while. Moreover, data suggests that consumers are unlikely to make purchases of durable goods because these have become more expensive, opening the door for secondhand items. However, one-fifth of consumers said the top reason they reduced spending on furniture and appliances in 2023 was because they had already purchased these items in the past.”

Another takeaway, the survey concluded, was that secondhand shoppers, motivated by saving 30% on average, said they are now shopping secondhand stores as heavily as stores with brand-new products.

This new “normal” of buying from secondhand retailers is a response to current economic conditions and is a direct result of unaffordable prices. This seems to suggest that consumers, in general, cut back spending on new products in 2021 and 2022, when prices increased substantially. Instead, they opted to tap secondhand retailers and are now repeat buyers in this market.

As a whole, secondhand consumers have purchased more used goods than new ones, indicating they are repeat customers in the secondhand market. Among consumers using secondhand channels, 59% of all clothing purchases occurred at these retailers in 2023, as did 64% of electronic purchases. Consumers report saving between 30% and 35% by shopping at secondhand retailers, which may be a significant driver behind this change in spending.

In its conclusion, the survey suggests inflation continues to have a negative impact on consumers’ purchasing power. It also found that affluent consumers are equally willing to shop secondhand stores for electronics and furnishings.

This shift, the study says, may suggest a changing trend, especially for high-end goods.

Considering that sales of higher-end home furnishings have historically been relatively impervious to economic dips, it will be interesting to track sales of better goods, especially considering the findings from this survey.

by

by

Inflation is the culprit? Absolutely….BUT it is minuscule compared to everything else happening in our economy.

Please read this and learn the real reasons why our industry is facing retail and manufacturing armageddon.

https://www.social4retail.com/it-has-been-stated-over-and-over-that-in-good-times-you-prepare-for-war-and-in-bad-times-you-prepare-for-peace-today-this-is-nonsense.html

Please prove me wrong.

Thanks for your thoughts, Bill. This provides an interesting perspective.