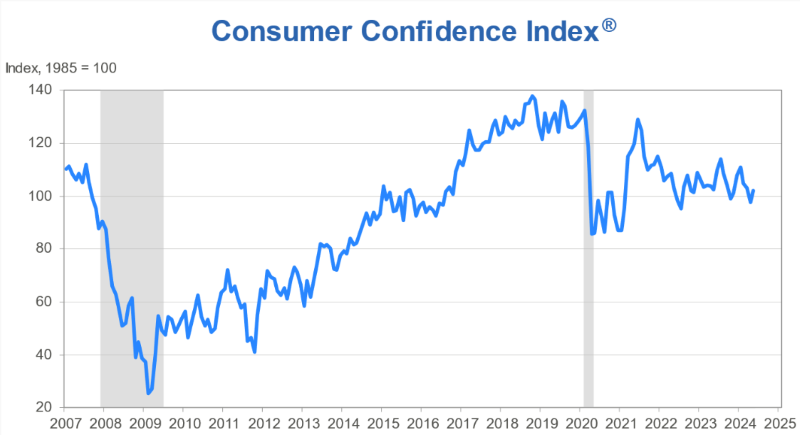

Monthly survey reflects an increase among all age groups and those earning more than $100,000

WASHINGTON — Consumer confidence rose slightly in May based in part on a strong labor market that continues to keep unemployment rates at near historic lows.

The Conference Board reported on Tuesday that consumer confidence rose to 102 in May, compared to 97.5 in April. This was also partly because of a rise in confidence among consumers of all age groups and those making over $100,000.

In addition, the Present Situation Index, which is based on consumers’ current assessment of business and labor market conditions, rose to 143.1 compared with 140.6 in April.

The Expectations Index, based on consumers’ short-term outlook for income, business and labor market conditions, also rose to 74.6, from 68.8 in April.

However, the Conference Board said this was the fourth month in a row the expectations reading was below 80, which signals a looming recession. The survey reflected this, as the perceived likelihood of a recession rose again this month, with more consumers believing it is “somewhat or very likely.”

“Confidence improved in May after three consecutive months of decline,” noted Dana Peterson, chief economist at the Conference Board, adding that consumers’ assessment of current businesses conditions was slightly less positive than last month. “However, the strong labor market continued to bolster consumers’ overall assessment of the present situation. Views of current labor market conditions improved in May as fewer respondents said jobs were hard to get, which outweighed a slight decline in the number who said jobs were plentiful. Looking ahead, fewer consumers expected deterioration in future business conditions, job availability and income, resulting in an increase in the Expectations Index. Nonetheless, the overall confidence gauge remained within the relatively narrow range it has been hovering in for more than two years.”

Peterson noted that consumer fears of a recession contrasts with CEO assessments of recession risk, with only 35% of CEOs surveyed in April anticipating a recession in the next 12-18 months. Peterson added that consumers were upbeat about the stock market, with 48.2% expecting stock prices to rise in the year ahead. This compares with 25.4 expecting a decrease and 26.4 expecting no change, she noted.

Meanwhile, purchasing plans for homes were unchanged in May, remaining at their lowest level since August 2012. Buying plans for autos, however, rose for a second month. Buying plans also increased for big-ticket appliances, rising for the first time in several months, officials said. In comparison, buying plans for electronics were unchanged, with the exception of smart phones, “which saw renewed interest.”

Other highlights of the report were as follows:

Of their present situation:

+ 20.3 % of consumers said business conditions were good, down from 20.8% in April.

+ 17.6% said business conditions were bad, unchanged from April.

Of the labor market:

+ 37.5% of consumers said jobs were plentiful, down from 38.4% in April.

+ 13.5% said jobs were hard to get, down from 15.5%.

Regarding their short-term outlook for business conditions six months from now:

+ 13.3% expect business conditions to improve, down from 13.4% in April.

+ 16.8% expect business conditions to worsen, down from 19.1%.

And regarding their short-term labor market outlook:

+ 12.6% said they expect more jobs to be available, up from 12.3% in April.

+ 18.2% anticipate fewer jobs, down from 19.8% last month.

And regarding their short-term income prospects:

+ 16.9% of consumers expect their incomes to rise, up from 16.8% in April.

+ 11% expect their incomes to decrease, down from 14%.