Nearly a quarter of those surveyed plan to buy a mattress in the first half of 2023 with 70% saying they plan to buy at a retail store

HIGH POINT — Following on the heels of upholstery and primary bedroom furniture, our latest Consumer Insights Now research segment takes a look at perhaps the next most logical area of interest to consumers — mattresses and bedding.

Once again, the survey asked about household buying plans in this category during the first half of 2023, surveying nearly 1,900 consumers across different age groups.

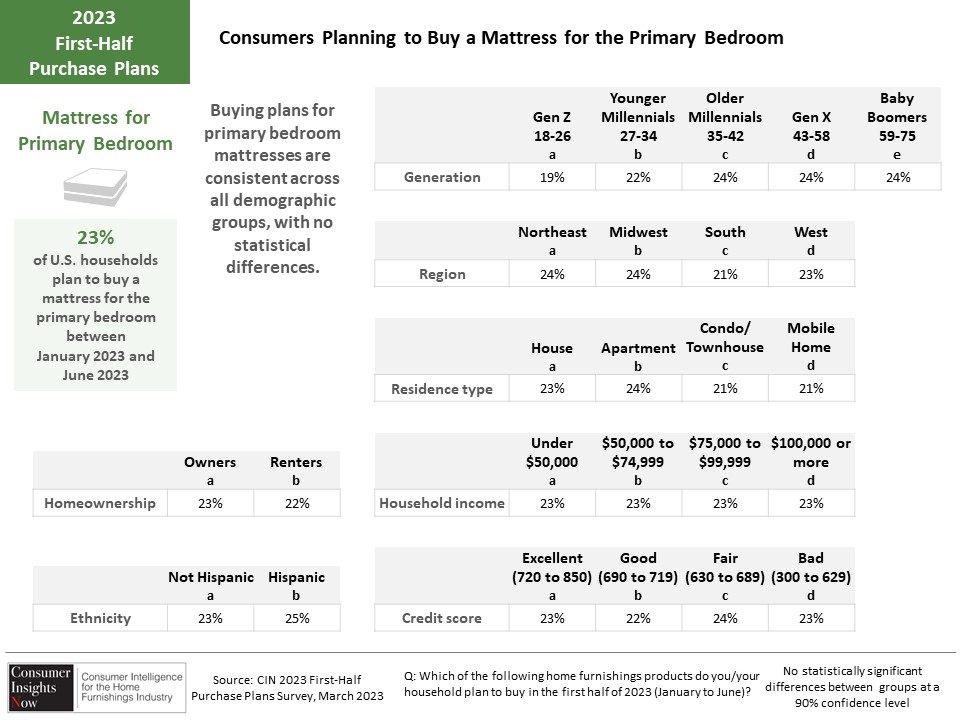

Mattresses manufacturers and retailers alike will be interested to know that 23% of shoppers surveyed plan to buy a mattress in the first half, a similar result as primary bedroom. The report also once again had encouraging news for brick and mortar retailers in that nearly 70% of those surveyed plan to buy in a store while just over 30% plan to buy online, with younger and older millennials choosing the latter channel of distribution.

A key advantage that consumers shopping retail stores have is the ability to test the product out, much like one would sit on a sofa or sectional. Some 77% of those surveyed said that it was important to lie down on the mattress before buying — with 86% of in-store shoppers wanting to test it out before buying compared to 54% of those shopping online.

This begs the question as to whether online shoppers would test it out in a physical store first then buy it online, or test it out when they receive it and decide whether it’s comfortable enough to keep or not.

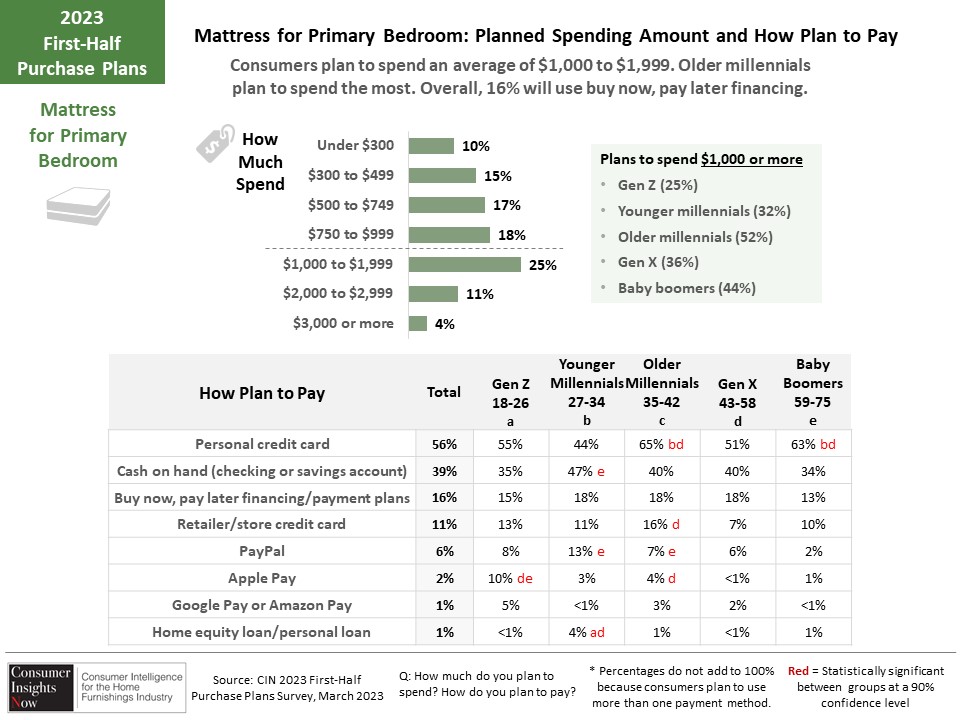

The largest percentage those surveyed — roughly 25% — plan to spend between $1,000 and $1,999, while 11% plan to spend between $2.000 and $2,999 and 18% plan to spend between $750 and $999.

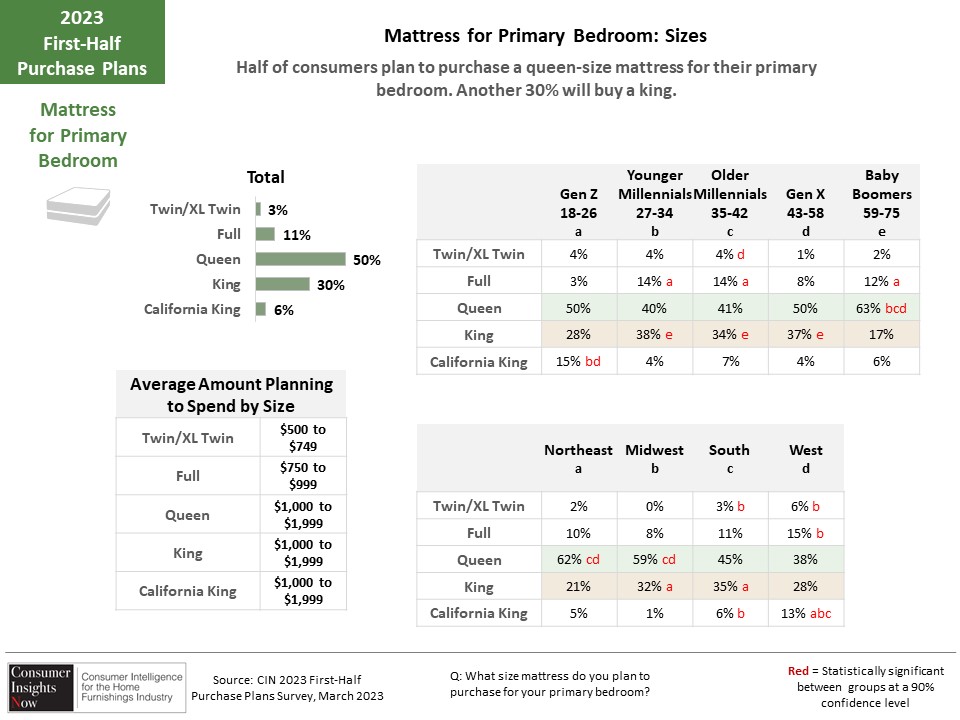

Another 32% plan to spend between $300 to $749. And half of those surveyed plan to buy a queen mattress, while 30% plan to buy a king. Some 11% plan to buy a full size mattress and only 3% plan to buy a twin or twin XL size mattress, which correlates with similarly lower numbers of consumers planning to buy youth bedroom furniture as seen in overall buying plans across categories during the first half.

Other key findings were as follows:

+ Some 31% of those surveyed plan to buy a memory foam mattress, compared to 30% who plan to buy a hybrid mattress and 9% who plan to buy an innerspring. Thirty percent said they were not sure, which offers another advantage for brick and mortar stores that offer a wide selection for consumers to test out in the physical store.

+ Fifty-three percent said they plan to buy a stationary bed frame while another 23% said they plan to buy an adjustable bed base. Another 24% said they were not sure, which gives them another chance to see the product mix in person at a retail store and decide which model they prefer.

+ Fifty-six percent of those surveyed said support was the most important feature of a mattress, followed by combination sleeper (side and other positions) 41%; cooling features and pressure relief, 40%.

+ Ninety-four percent said they were replacing an existing mattress. Millennials and GenX consumers were the most likely to replace a mattress between five and 10 years old, while baby boomers were most likely to be replacing a mattress that’s more than 10 years old. Nearly 30% said they were looking to replace a mattress between nine and 14 years old and 52% said they were looking to replace a mattress between three and eight years old.

+ Fifty-eight percent said that their current mattress was worn out and 38% said it is uncomfortable. Eighteen percent wanted a larger mattress, and 13% respectively said they were moving to a new home or apartment or wanted to try out new technology being offered in the category.

+ And most surveyed — 43% — said they expect their mattress to last between 5 and 9 years, compared to another 30% who said they expect it to last 10-14 years.

In addition the survey looks at other areas of interest in the category including what types of accessories are most sought after, ranging from pillows and mattress toppers to blankets and mattress pads. Also of interest is how they plan to pay for their selection in the current economic times.

The bedding segment received some of the most varied and interesting responses among the categories we’ve covered thus far. We hope that it is of interest to your business to and provides some insights into what consumers are looking for in the category. With this information in hand, we hope it offers compelling data to support not only your own buying decisions, but also bolster your success in the category.